USDC is the second most popular stablecoin as of March 2024. It is a centralized stablecoin issued and operated in accordance with US law. USDC was created by the Centre consortium, established by Circle, Coinbase, and Bitmain.

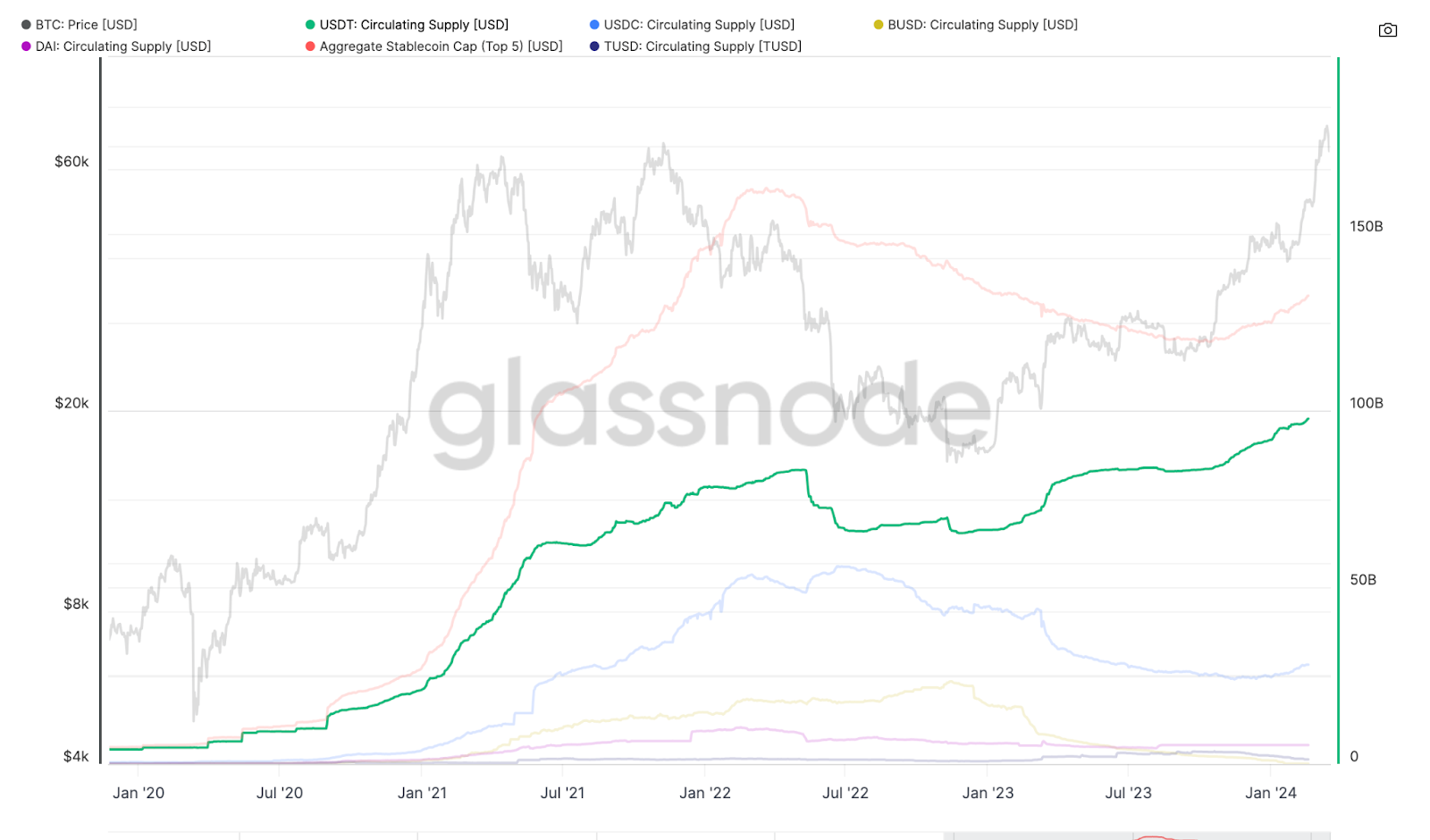

USDC has open-source code, allowing anyone to review it and suggest changes. As of March 2024, the market capitalization of USDC is approximately $31 billion, making it second only to USDT in this regard.

In 2022 the capitalization of USDC experienced a significant increase, and there were attempts to surpass USDT. However, in 2023, the market cap decreased significantly, only beginning to recover in 2024.

Below is a noticeable significant decrease in USDC issuance for the second half of 2022 and the first quarter of 2023, followed by a gradual increase starting from the second quarter of 2023.

History of USDC

USDC was announced in May 2018 and launched in September of the same year.

USDC aims to create a more transparent and reliable stablecoin compared to those existing in the market.

At its launch, USDC received $110 million in investments from Goldman Sachs, Breyer Capital, and other notable investors.

Debuting in 2018 on the Ethereum blockchain, USDC is now available on other popular blockchains, including BNB, Tron, Solana, and Algorand.

USDC Backing

Unlike decentralized stablecoins such as DAI, USDC is backed by traditional assets: bonds and fiat currency. This makes USDC more resilient to market fluctuations but also more vulnerable to regulatory risks.

Upon the issuance of new tokens, an equivalent amount of USD is held in cash and short-term US Treasury bonds. This ensures the peg of USDC to the value of USD.

While USDC previously held a small amount of commercial bonds, the company now claims to hold only Treasury bonds.

Circle’s audit is conducted by the major auditing firm Grant Thornton.

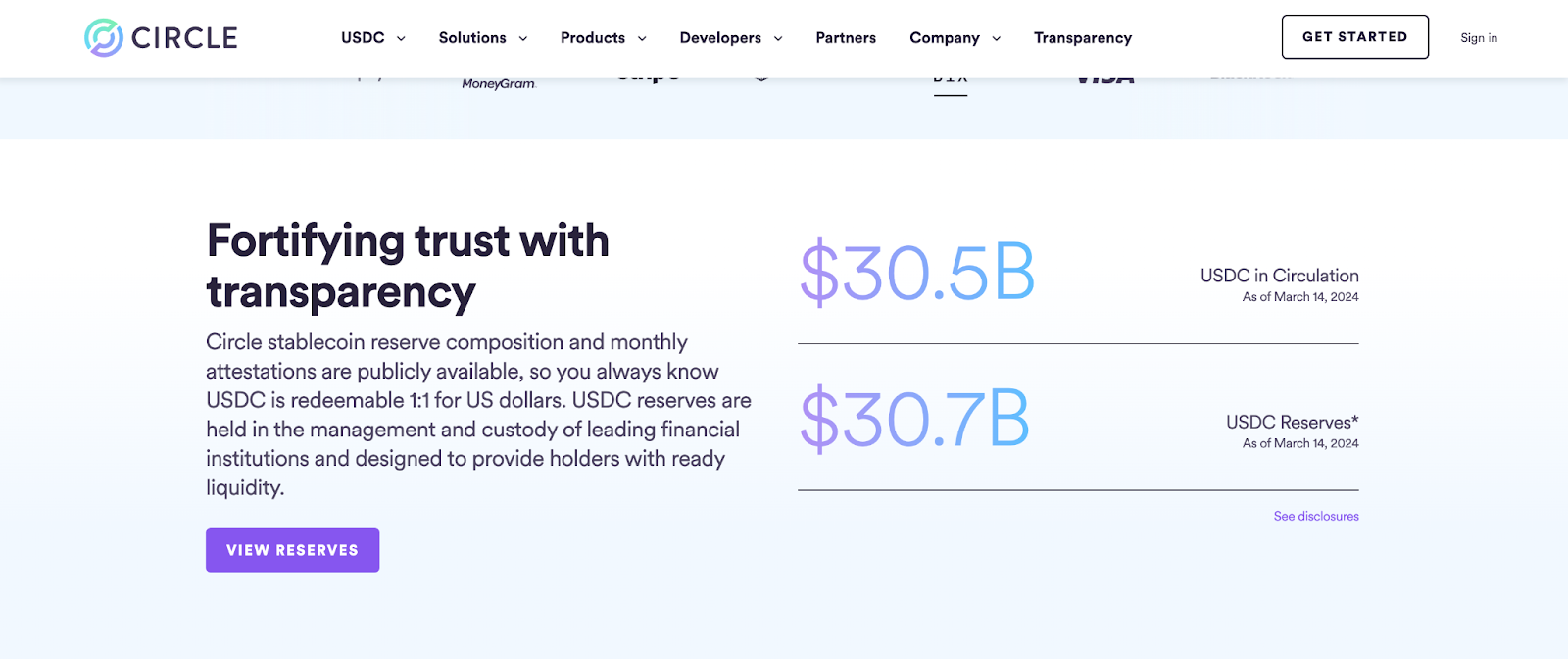

On March 14, 2024, Circle reported that USDC was backed by 86,65% ($26.6 billion) in short-term US Treasury bills. These reserves are held by BNY Mellon, with asset management by BlackRock.

The cash portion of the USDC reserve, amounting to $4.1 billion (13.35% of assets), is also primarily held at BNY Mellon. Information on USDC backing and monthly reports on USDC reserves are available via the link.

Why Does the USDC Exchange Rate Remain Stable?

The exchange rate of USDC remains stable due to each token being backed by one US dollar in a bank account. This allows the use of USDC for transactions with minimal volatility and risk.

USDC is created through a smart contract each time a dollar is deposited. Each USD coin can be exchanged for one dollar and is backed either by one dollar or by an asset expressed in US dollars (fiat currency) held in accounts at regulated institutions in the United States.

When USDC is exchanged back into dollars, the coins are irreversibly destroyed, and the funds from the underlying reserves are returned to the customer.

Application of USDC

- Payments: USDC is used for instant and reliable payments with low fees.

- Investments: USDC is applied to minimize risks and diversify portfolios.

- DeFi: USDC is used in many DeFi projects for lending, staking, farming, and other financial services.

- Trading: USDC is used for trading on centralized and decentralized cryptocurrency exchanges.

- Money transfers: USDC is used for sending funds across borders. Recipients can hold USDC without using a bank account and without worrying about price volatility

- Visa: Since December 2020, Circle and Visa have teamed up to integrate USDC into the Visa ecosystem, allowing users to send and receive USDC through the Visa network and connect it to Visa cards.

USDC Advantages

- Stability: With rare exceptions, the USDC exchange rate is equal to the USD rate.

- Wide availability: USDC is available on most cryptocurrency exchanges and is actively used in DeFi.

- Regular audits: The company is registered in the USA, so Circle’s financial reporting undergoes an annual audit and is subject to SEC scrutiny.

- Multi-network nature: USDC is available on multiple blockchains, allowing users to easily transfer and use USDC on various networks such as Ethereum, Tron, BNB, Solana, Algorand, Avalanche, and others.

USDC Disadvantages

- Centralization: USDC is managed by Circle and Coinbase, making it vulnerable to regulatory attacks.

- Funds freezing: Unlike decentralized stablecoins, funds in USDC can be frozen or confiscated, even on non-custodial wallets.

- Regulatory risks: Increased regulatory pressure on centralized stablecoins may create problems for USDC.

USDC Prospects

The partnership with Visa increases the attractiveness of USDC as a payment tool.

However, the increasing regulatory pressure poses high risks for USDC and enhances the attractiveness of decentralized alternatives such as DAI.

Wallets Supporting USDC

USDC can be used on any wallets that support ERC-20 tokens:

- MetaMask

- TrustWallet

- Atomic Wallet

- Exodus

- Ledger