BUSD was produced by Paxos in conjunction with Binance, until Paxos stopped producing stablecoin after a lawsuit with the SEC. Paxos is a technology company specializing in blockchain.

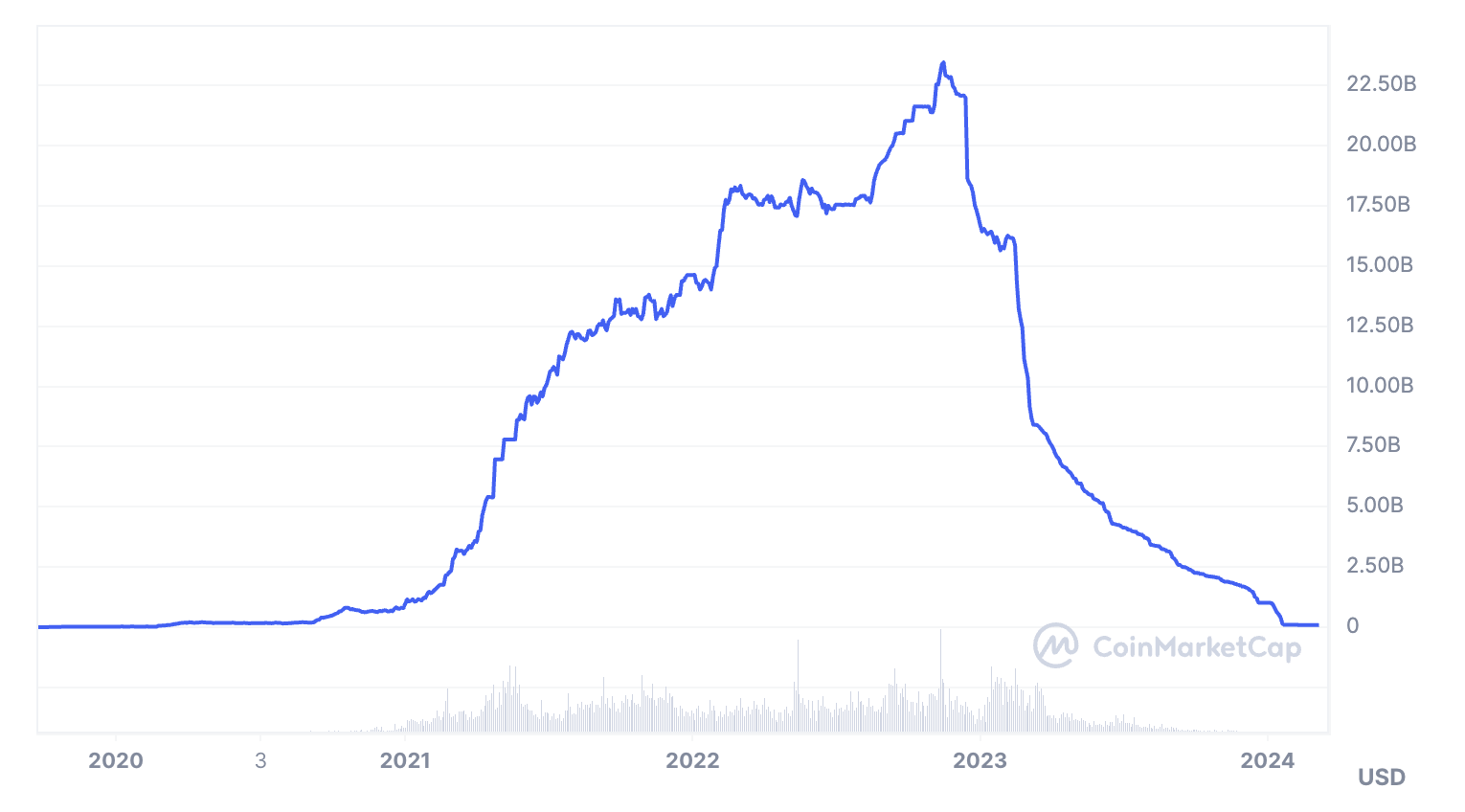

The BUSD code is open. Anyone can review it and propose changes. The issuance of BUSD is approximately $85 billion. Since November 2022, the asset has lost about $23 billion in volume, which is clearly visible on the chart.

There are several reasons for such a sharp decline:

- Loss of peg to the dollar in November 2022, January, and March 2023 due to lack of proper collateral.

- After review by the US Securities and Exchange Commission (SEC), Paxos ceased issuing BUSD in February 2023. After that, many investors redeemed or converted BUSD into other assets.

- A huge outflow of funds (about $500 million) occurred within 24 hours of the lawsuit being filed against Binance.

All of this has not only affected the change in the stablecoin’s market capitalization but also its price.

As a result, the reserve volume of BUSD tokens on the Binance exchange has significantly decreased.

History of BUSD

In September 2019, Binance announced the launch of a new stablecoin. The token was developed in partnership with the regulated financial organization Paxos. Binance CEO Changpeng Zhao stated that the new token would be fully backed by US dollars.

The launch of Binance USD was a significant milestone for Binance. The BUSD token was created using the Ethereum ERC-20 standard, but now BUSD is also available on other popular blockchains, including BNB, Tron, Solana, and Algorand.

After the suspension of the stablecoin issue by Paxos, Binance began abandoning BUSD.

Binance phased out its support for BUSD products. Users were urged to transition their BUSD holdings to alternative assets offered by Binance by February 2024.

As of March 2024, there are no more BUSD on the exchange.