What is an Option and How Does it Work

An option, or option contract, is an agreement that allows an investor to sell or buy an asset at a predetermined price within a set period.

An option has both a seller and a buyer. The buyer gains the right to transact the asset specified in the option contract, while the seller commits to fulfilling this transaction with the buyer.

The asset in question is known as the underlying asset, which can be anything from bitcoin and gold to stocks, etc. The price at which the asset is sold or bought is called the strike price or the execution price.

For acquiring the right to this transaction, the buyer pays a premium. This premium is always paid, although exercising the right granted by the contract is not mandatory.

An option has a lifespan, during which the buyer may utilize it. Its expiration marks the end of its validity.

The cut-off price is the benchmark price used for calculations, essentially the minimum price at which the asset can be sold.

Options are versatile in that they can be used to profit from both the decline and rise of the underlying asset’s price. This flexibility enhances earning potential but also complicates trading with this instrument.

Let’s break down how it works with an example.

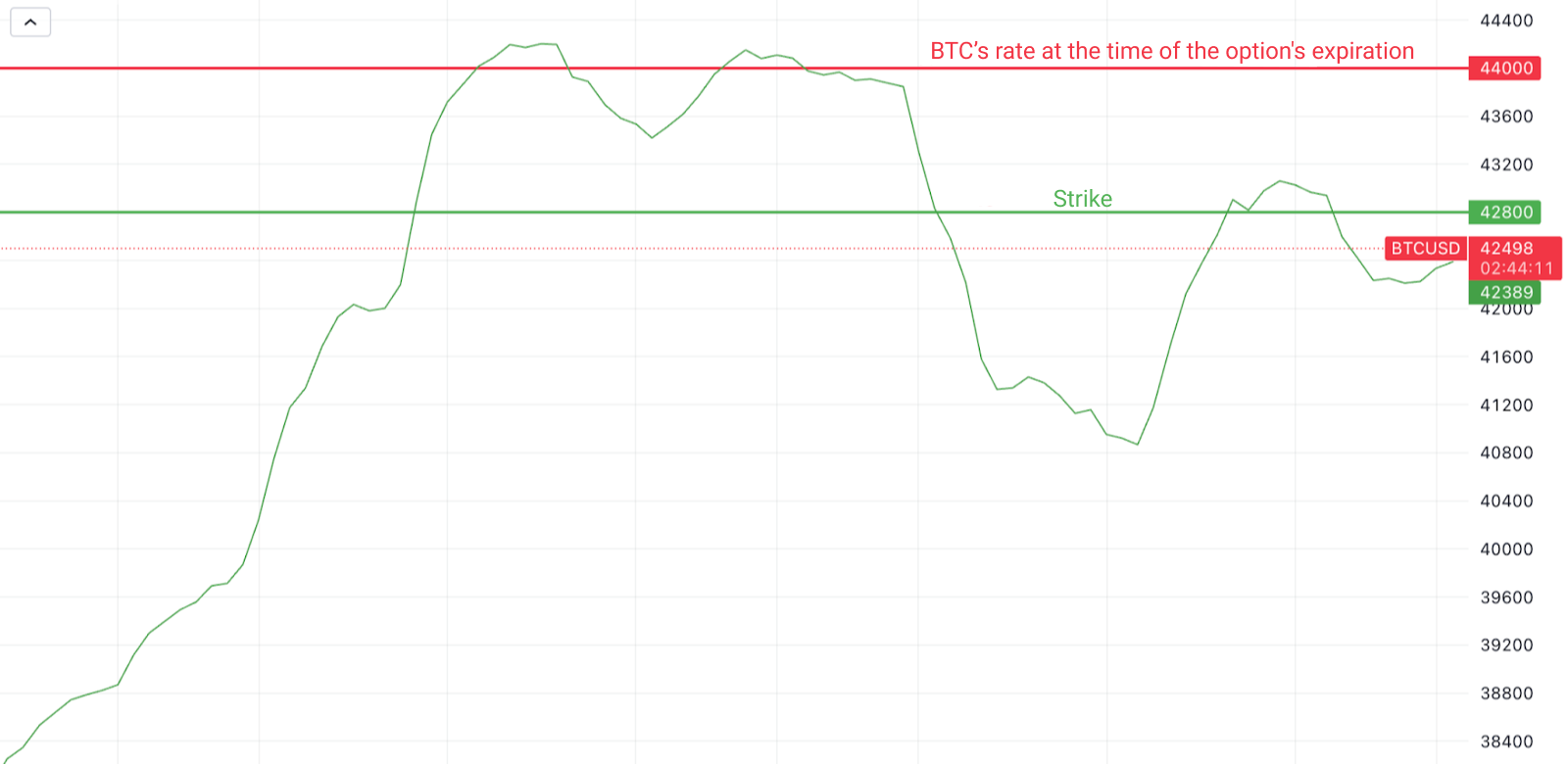

Suppose you purchased a bitcoin call option with a strike price of $42,800 and a premium of $200. While awaiting expiration, the BTC rate rises to $44,000.

At expiration, you buy BTC at $42,800 and sell it on the exchange at the market rate of $44,000. Your net profit is $1,000, considering the $200 paid for the option premium.

Now, to simplify, let’s remove the terms and go over it again for reinforcement.

You buy an option for $200, giving you the right to purchase bitcoin at $42,800 when it expires. While you wait for this date, the BTC rate reaches $44,000. You exercise the option and then sell the bitcoin at the market rate. The net profit is $1,000 since you effectively spent $43,000, including the option’s price, and sold at $44,000.

If you plan to engage in options trading or delve deeper into it in the future, it’s crucial to understand the basic terms to ensure materials using them don’t seem like a foreign language.

Practical task

Task:

Answer 3 questions.

Condition:

Question No. 1. The price at which the underlying asset will be bought/sold is …?

- Strike

- Base price

- Slippage

Question No. 2. What is the expiration date of the option?

- Repayment date

- Expiration

- Fixation

Question No. 3. Is it possible not to pay an option premium?

- Yes

- No

- It depends on the option

Option Classification

Options are categorized into different groups based on specific criteria. Here are the main ones:

- Execution: when the option can be exercised, i.e., the right it grants can be used;

- Underlying asset: what asset the option is tied to;

- Action: what the option allows (buying or selling the asset).

Types of Options by Action

There are two types of options based on action, regardless of the underlying asset or the conditions of execution.

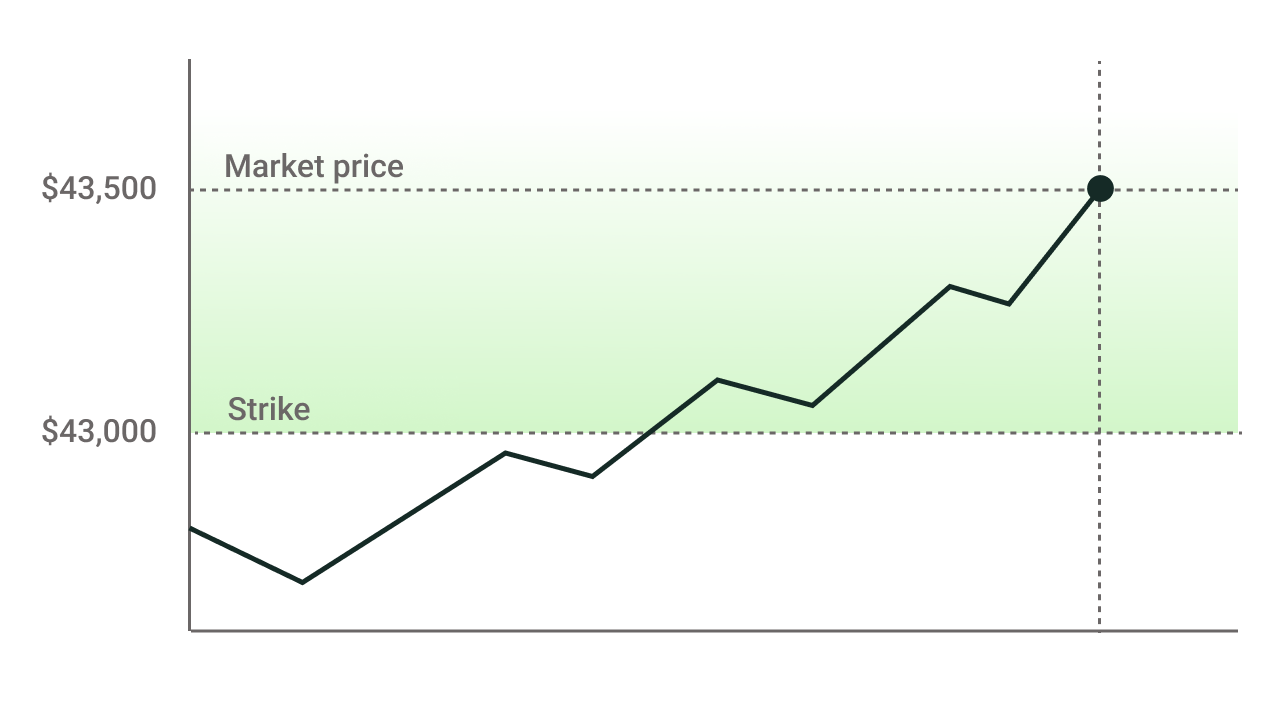

Call Option: Gives the buyer the right to purchase the underlying asset, obligating the seller to sell it upon the buyer’s request. It allows the buyer to profit from the asset’s price increase relative to the strike price.

For example, you bought a call option on bitcoin with a strike price of $43,000. The market rate is currently $43,500. You execute the option and sell BTC at the market rate, earning $500.

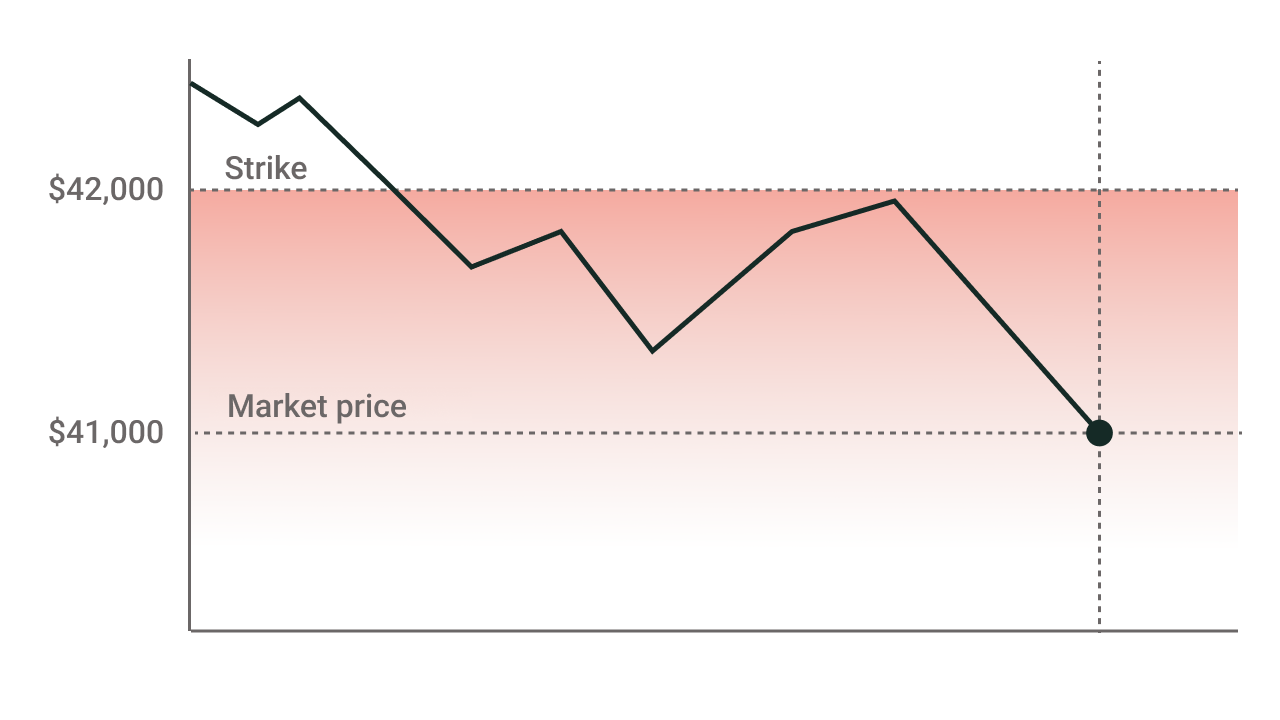

Put Option: Gives the buyer the right to sell the underlying asset, obligating the seller to buy it upon the buyer’s request. It allows the buyer to profit from the asset’s price decrease relative to the strike price.

For example, you bought a put option on bitcoin with a strike price of $42,000. The market rate drops to $41,000; you buy BTC at this price and execute the option, selling bitcoin at $42,000, earning $1,000.

We’ve discussed situations where it’s beneficial for the option buyer to exercise, but when does the seller profit? It’s simple. The option seller profits:

- When the option is not exercised, collecting the premium without engaging in a transaction with the underlying asset;

- When the option is exercised, and losses from the transaction with the underlying asset are covered by the premium.

The first case is straightforward: the buyer pays the premium and doesn’t use the option, while the seller just collects the money. Let’s examine the second case with an example.

You sell a put option on bitcoin with a strike price of $42,000 and receive a $500 premium. The market rate drops to $41,800. The buyer exercises the option, obligating you to buy BTC at $42,000. You lose $200 on this transaction but remain in profit by $300 due to the premium.

When trading options, there are three scenarios. They differ in how the strike price compares to the market price of the underlying asset and who benefits from the situation.

In-the-money (ITM): The strike price to market price relationship is favorable for the option buyer. An option is in the money when the current price of the underlying asset is higher (for calls) or lower (for puts) than the strike.

Out-of-the-money (OTM): The strike price to market price relationship is favorable for the option seller.

At-the-money (ATM): The strike price and market price are nearly equal.

Types of Options by Execution

The timing of an option’s execution plays a key role in profitability. There are four main types.

European Option: Executed at the expiration date.

American Option: Can be executed at any time before expiration.

Quasi-American Option: Can be executed during predetermined periods before expiration. There may be multiple periods.

Asian Option: The execution price is based on the average price of the underlying asset over a specific period.

Practical Task

Task:

Determine what situation the option is in.

Condition:

Option No. 1. You have bought a call option with a strike of 200 rubles. The market value of the underlying asset is 120 rubles.

Answer options:

- In money

- Beyond money

- The money

Option No.2. You bought a Bitcoin put option with a strike of $42,000. BTC is currently worth $41,900.

Answer options:

- In money

- Beyond money

- The money

Option No.3. You sold a put option with a strike of $500 and received a commission of $300. The market price of the underlying asset is $350.

Answer options:

- In money

- Beyond money

- The money

Predicting Option Price Changes

The price of an option, i.e., the premium received by the seller, can change. It doesn’t remain static while the option can be bought.

What Determines the Option Price

The premium depends on the option’s intrinsic and time value, as well as the type.

Premium = Intrinsic Value + Time Value

Intrinsic Value: The difference between the strike price and the market price. For a put option, it arises when the asset’s price falls below the strike; for a call option, when the asset’s price rises above the strike.

Time Value: Market expectations, which in turn result from the volatility or variability of the price over a certain period. The higher the volatility and the longer the time until expiration or that specific period, the higher the time value.

The Greeks are used to assess how option parameters affect the premium.

Option Greeks

The Greeks are coefficients that account for various factors and their impact on the premium.

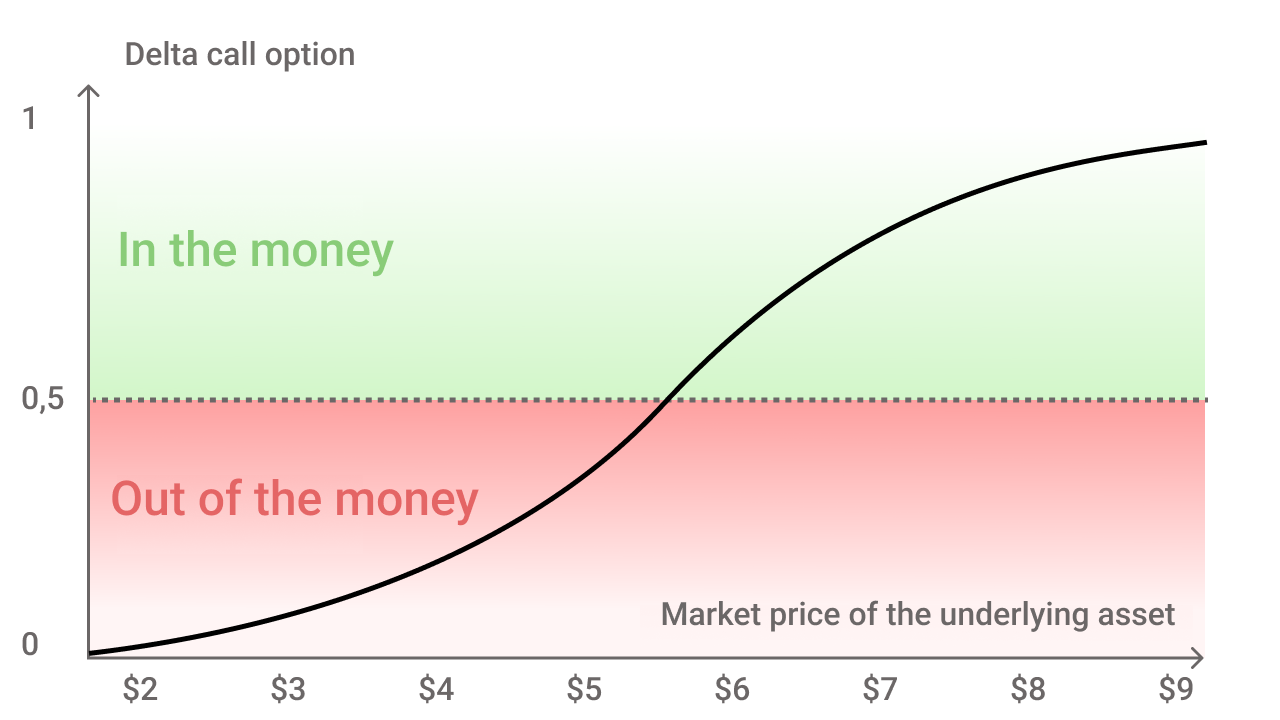

Delta indicates how the underlying asset’s price affects the premium. It ranges:

- For call options, from 1 to 0;

- For put options, from -1 to 0.

Delta signifies the likelihood of an option being in the money. The closer to one, the deeper in the money it is. At 0.5, the option is at the money, and at 0, it’s deep out of the money.

Delta shows how the premium changes with a one-point change in the asset’s price.

Gamma reflects how quickly delta changes if the underlying asset’s price changes, i.e., the speed of premium change. For option sellers, it will be negative, and for buyers, positive.

The closer an option’s strike price is to the current price of the underlying asset, the higher its gamma. Gamma is also higher for options with nearer expirations.

As previously mentioned, the buyer pays a premium to the seller. This premium decreases over time, indicated by Theta. The closer to the expiration date, the cheaper the option becomes.

Vega shows how the underlying asset’s price volatility affects the premium. The higher the volatility, the more expensive the option.

Practical Task

Task:

Answer 3 questions.

Condition:

Question No. 1. What is used to determine the impact of volatility on the premium?

- Gamma

- Delta

- Vega

- Theta

Question No. 2. What coefficient reflects the dynamics of delta change?

- Gamma

- Delta

- Vega

- Theta

Question No. 3. For which option is the delta measured from 1 to 0?

- Call option

- Put option

Option Strategies

Various strategies are employed when trading options. Let’s examine one known as the “Iron Condor,” which we use for our “Capital Protection” investment product.

Iron Condor: This strategy is based on two combinations of four options, allowing for profit when the price of the underlying asset remains within a certain range between the strikes.

First Combination “Profit”:

- Sell an out-of-the-money call option;

- Sell an out-of-the-money put option.

The premium profit is fully retained if neither option is exercised before expiration.

Second Combination “Insurance”:

- Buy call and put options even further out-of-the-money than those sold.

These options help protect in case the sold options end up in the money.

The strategy’s advantages include limited potential losses, limited risk, and the possibility of profiting in the absence of significant price movements.

Let’s clarify with an example.

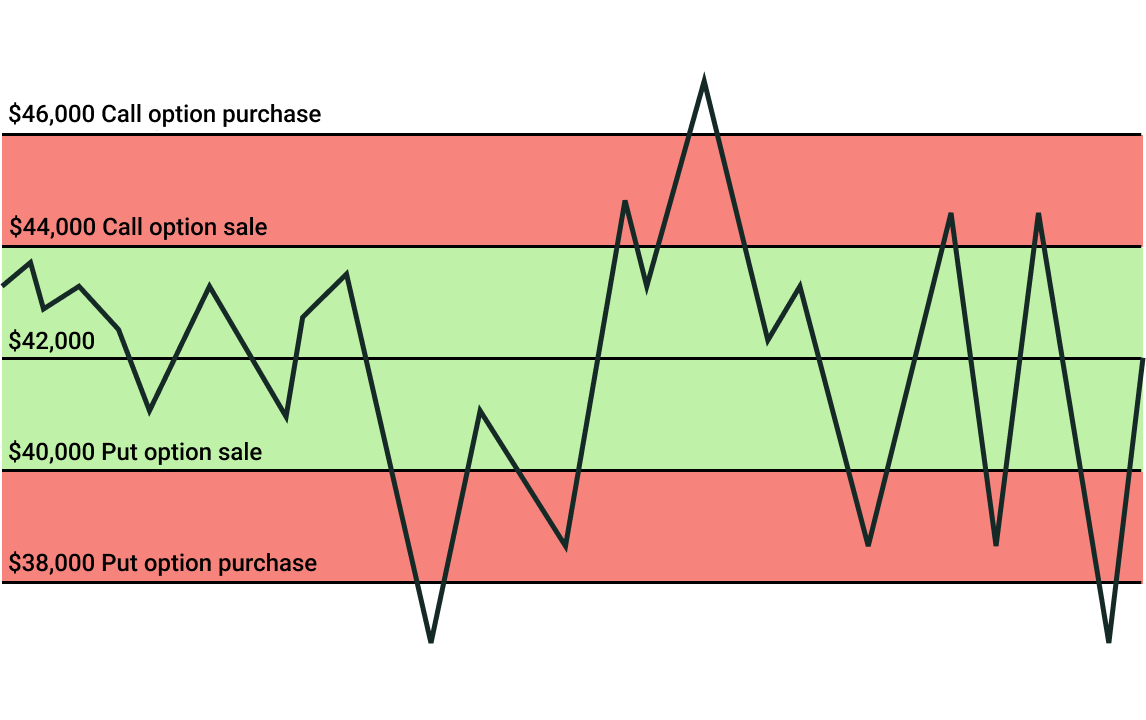

Consider bitcoin as the underlying asset with a current rate of $42,000. Here are our positions with a single expiration date:

Selling a Call Option

Strike: $44,000

Premium: $650

If the option is exercised, we must sell bitcoin at $44,000.

Selling a Put Option

Strike: $40,000

Premium: $650

If the option is exercised, we must buy bitcoin at $40,000.

Buying a Call Option

Strike: $46,000

Premium: $325

If the option is exercised, we buy bitcoin at $46,000.

Buying a Put Option

Strike: $38,000

Premium: $325

If the option is exercised, we sell bitcoin at $38,000.

Now, let’s visualize this on a graph.

Green Zone: Profit

Red Zone: Fixed Risk

White Zone: Outside Our Operational Area

The essence is that we limit our losses and set a precise profit.

If the rate stays within our sold options’ boundaries with strikes at $40,000 and $44,000, we earn $1,300 from premiums and spend $650 on buying options.

Net Profit: $650.

This is also taken into account when calculating losses, should they occur.

For example, if bitcoin drops to $37,000 on expiration day, the bought put option with a $38,000 strike and the sold one at $40,000 are executed.

We buy BTC at $40,000 and sell at $38,000, losing $2,000. This way, we limit losses. Without the protective put option at a $38,000 strike, the downturn would have been $3,000.

Including profit, the maximum potential loss is $1,350.

Given the difficulty in predicting market falls, we set limits in advance rather than leaving it to chance.

Risks in Options Trading

Buyers and sellers are on opposite sides of the profit camp in options trading, so their strategies and risks differ.

Buyers are in a more protected position since their risks are limited to losing money on the premium paid to the seller. They don’t have to execute the option at a loss, only pay the premium. Thus, buyers can predetermine their maximum loss ceiling.

Sellers, however, are not shielded from market changes. By selling an option, they commit to executing it upon the buyer’s request, without the option to refuse. Hence, their loss ceiling is unlimited. In exchange, their income is guaranteed.

Dynamic Delta Hedging

One risk management strategy employed is dynamic delta hedging (DDH).

This strategy involves regularly adjusting the portfolio to keep its delta close to zero or another desired level, minimizing the impact of underlying asset price changes on the option portfolio’s value.

Dynamic delta hedging is conducted by trading the underlying asset or other financial instruments in such a way that changes in their value offset changes in the option’s value.

For instance, if you have a portfolio of stock options and wish to make it delta-neutral (delta equals zero), you might sell some stocks or buy put options as the stock price rises to balance the delta and reduce risk.

Practical Tasks Answers

What is an Option and How Does it Work

Question No. 1 — Strike

Question No. 2 — Expiration

Question No. 3 — No

Option Classification

Option No. 1 — Out of the Money

Option No. 2 — For money

Option No. 3 — In the money

Predicting Option Price Changes

Question No. 1 — Vega

Question No. 2 — Gamma

Question No. 3 — Call option