In this article, we will delve into Solana cryptocurrency, highlighting its unique features compared to other blockchain networks. We’ll also explore Solana’s key innovations and practical applications. Additionally, we will discuss Solana price predictions and the various factors influencing its market value.

Introduction to Solana (SOL)

What is Solana?

Launched in 2020 by a team of former engineers from Qualcomm, Intel, and Dropbox, Solana is a blockchain network designed to address common blockchain challenges. Renowned for its outstanding performance, scalability, and low transaction costs, Solana has quickly become a leading choice in the blockchain space.

Key Features and Innovations

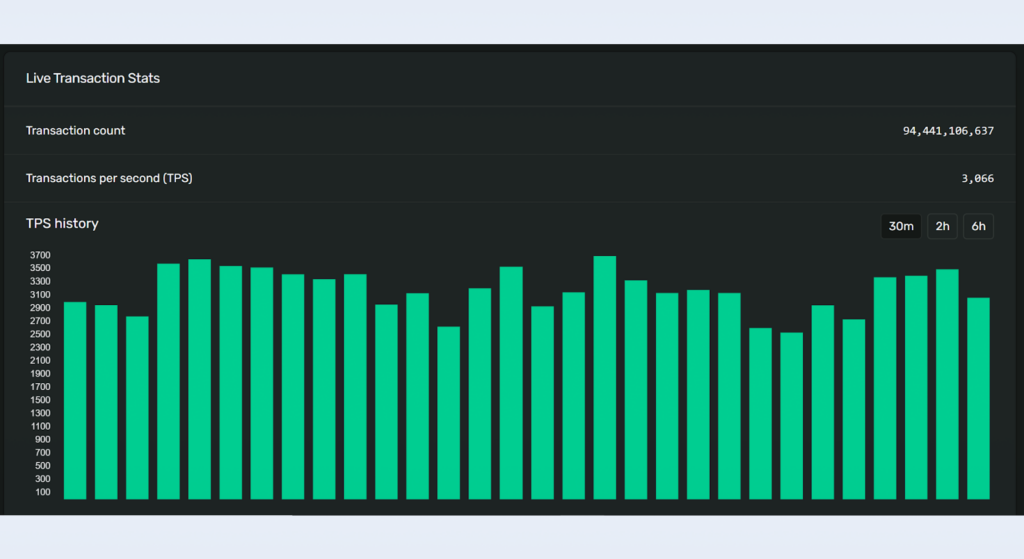

Solana’s most notable innovation is its Proof of History (PoH) mechanism, a unique technology that establishes a verifiable timeline to confirm events at specific times. By leveraging cryptography, PoH organizes transactions efficiently and securely, significantly boosting network throughput. This advancement positions Solana as one of the fastest blockchain networks, capable of handling thousands of transactions per second (TPS).

High Throughput and Scalability

Solana boasts a throughput of over 50,000 TPS, with potential scalability reaching up to 710,000 TPS. This high performance is essential for rapid applications requiring low latency, contributing to Solana’s popularity in the decentralized finance (DeFi), gaming, and non-fungible token (NFT) sectors. For context, traditional financial systems like Visa manage around 24,000 TPS.

Low Transaction Fees

The transaction fees on the Solana network are exceptionally low, averaging about one-fourth of a cent. This economic efficiency is advantageous for developers and users engaged in high-frequency trading or applications that involve micro-transactions. Moreover, the low fees enhance Solana’s appeal for NFT creation and trading, where transaction costs can directly affect the profitability of projects.

Current Market Overview

Market Position and Valuation

As of 2024, Solana ranks among the top five cryptocurrencies by market capitalization, as reported by CoinMarketCap. With a market cap exceeding $67 billion, Solana is positioned fifth in the capitalization rankings, trailing just behind BNB.

Recent Price Performance

What is solana trading at right now? In June 2024, the solana price USD was approximately $145, with a 24-hour trading volume surpassing $3 billion. From 2023 to 2024, the SOL token price experienced a dramatic increase of over 800%, climbing from about $16 to nearly $150. Bitcoin’s halving has influenced the price of Solana, as well as many other cryptocurrencies.

Market Sentiment and Trends

The current market sentiment for SOL crypto is overwhelmingly positive and optimistic. This optimism is fueled by technological advancements, ecosystem growth, and favorable market conditions. The substantial market capitalization indicates strong investor confidence and interest in the platform’s long-term prospects.

Factors Influencing Solana’s Price

Technological Developments

Here are Solana’s major innovations that make it a key player for the DeFi, NFT, and gaming segments. It’s important to study these factors to make a Solana price prediction and understand: why is solana dropping or rising.

- Proof of History (PoH) Mechanism: this innovative technology improves the network’s throughput and efficiency.

- High TPS and Scalability: Solana’s capability to handle high transaction volumes makes it ideal for demanding applications.

- Low Transaction Costs: the network’s affordability is advantageous for both ordinary users and developers.

- Network Upgrades and Stability: integrations like Turbine, which improves TPS and boosts the performance of the network.

- Ecosystem Tools and Developer Support: comprehensive SDKs, detailed documentation, an active developer community, and cross-chain compatibility ensure robust support for developers.

Adoption and Use Cases

Major DeFi platforms built on Solana include:

- Serum: A decentralized exchange (DEX).

- Raydium: An automated market maker (AMM) that offers liquidity for trading pairs in partnership with Serum.

- Solend: A decentralized platform for lending and borrowing.

The NFT boom owes much to the Solana blockchain. By 2024, more than 110 million NFTs have been minted on the platform. This scalability has allowed Solana to support a vast ecosystem of NFT projects and marketplaces, such as Solanart and Magic Eden. Creating an NFT on Solana costs as little as $0.00011, which is significantly cheaper than on other blockchains like Ethereum.

Market Competition

Ethereum

Ethereum stands as the leading platform for smart contracts with an extensive ecosystem of decentralized applications (dApps). Despite its prominence, Ethereum faces challenges such as limited scalability and high transaction fees.

BNB Chain

BNB Chain (former Binance Smart Chain) is renowned for its high throughput and low transaction costs. However, it often faces criticism for its centralized nature, which differentiates it from more decentralized blockchain networks.

Cardano

Cardano is distinguished by its rigorous, peer-reviewed academic approach to blockchain development, which emphasizes security and sustainability.

Avalanche

Avalanche employs a unique consensus protocol and offers robust support for blockchain interoperability, enabling seamless interaction between different blockchain networks.

Polkadot

Offers interoperability through its Relay Chain and parachain architecture, with a robust governance system for protocol upgrades.

Regulatory Environment

The regulatory landscape, particularly in the United States, influences Solana’s adoption and investment appeal. Increased scrutiny, especially following events like the FTX collapse, could lead to stricter regulations for exchanges and projects associated with Solana.

Expert Predictions and Analysis

Short-Term Predictions

Analysts from platforms like Changelly and CoinCodex predict that the SOL coin could see significant recovery and growth in 2024. Predictions indicate that SOL could average between $150 and $200 USD, with potential peaks up to $500 under favorable conditions.

Long-Term Forecasts

Analysts are optimistic about Solana’s long-term prospects, projecting significant growth over the next decade.

SOL coin price prediction for 2024 is to reach a maximum of around $400, with average predictions suggesting values between $92 and $357 of the solana price target.

What’s ahead for the price of solana in 2025 and how much will solana be worth in 2025? By 2025, solano price could reach new highs, with estimates ranging from $222.31 to $298. These predictions are supported by anticipated technological improvements and mass adoption.

Long-term projections are even more optimistic: some experts make solana price predictions for 2030 that SOL price will reach between $1,136 and $1,297.

Technical Analysis

Historical Price Patterns

After the launch in 2020 solona price was at around $0.22 per SOL. During a bull market in November 2021, SOL achieved an all-time high of approximately $260.

The broader market decline in late 2021 and early 2022, along with network outages and the collapse of the FTX exchange led to a sharp decline in SOL price.

By mid-2022, SOL cryptocurrency had dropped to below $50, reflecting a more than 80% decline from its all-time high.

In 2023, the price of SOL began to recover.

Key Support and Resistance Levels

The $150 to $160 range is a critical resistance level for Solana value. The $200 to $210 range is another significant resistance.

On Bitbanker you can easily and safely trade cryptocurrency with Limit and Market Orders.

Technical Indicators and Signals

The relative Strength Index (RSI) is an essential tool for the analysis of overbought or oversold conditions, which can help determine potential support and resistance levels. It can help to understand why solana is rising or not.

Moving Averages. Key moving averages, 50-day and 200-day moving averages for instance, also provide insights into support and resistance levels.

Bullish Signals: RSI Trending Upwards, Bullish MACD Crossover, Support at 50-Day Moving Average.

Bearish Signals: RSI Above 70, Bearish MACD Crossover, Resistance at 200-Day Moving Average.

Solana in Comparison to Other Cryptocurrencies

Solana vs. Ethereum

Speed: Solana — over 50,000 TPS and around 400,000 max TPS (while Ethereum 2.0 — between 20 000 and 100 000).

Transaction Costs: Solana has consistently low fees, often less than a cent per transaction. Ethereum — high fees, ranging from $10 to $50 during peak times.

Security and Decentralization: despite its key innovations of PoH and PoS, Solana faces reliability issues and has fewer validators, raising centralization concerns, Ethereum is highly decentralized with a robust PoS system, extensive validator network, and security that has been proven.

Solana vs. Cardano

Speed: Сardano handles around 250 TPS, with future improvements expected from layer-two solutions like Hydra. Solana with over 50,000 TPS is thus much higher than the one of Cardano.

Transaction Costs: Cardano has predictable and fair fees, higher than Solana but still relatively low.

Security and Decentralization: Solana has fewer validators due to high node costs that raise centralization concerns, Cardano uses the Ouroboros PoS protocol, designed for security and decentralization, with many independent stake pool operators.

Risks and Opportunities

Potential Risks

- Network Stability. Solana has encountered multiple outages, particularly during times of high demand, which raises concerns about its reliability.

- Centralization Concerns. The high-performance requirements for operating Solana nodes result in fewer nodes compared to more decentralized platforms like Ethereum and Cardano.

- Intense Competition. Solana faces fierce competition from other major blockchain platforms, including Ethereum, Binance Smart Chain, and Cardano.

- Regulatory Risks. The regulatory environment poses risks, particularly in jurisdictions with stringent regulations on cryptocurrencies.

Growth Opportunities

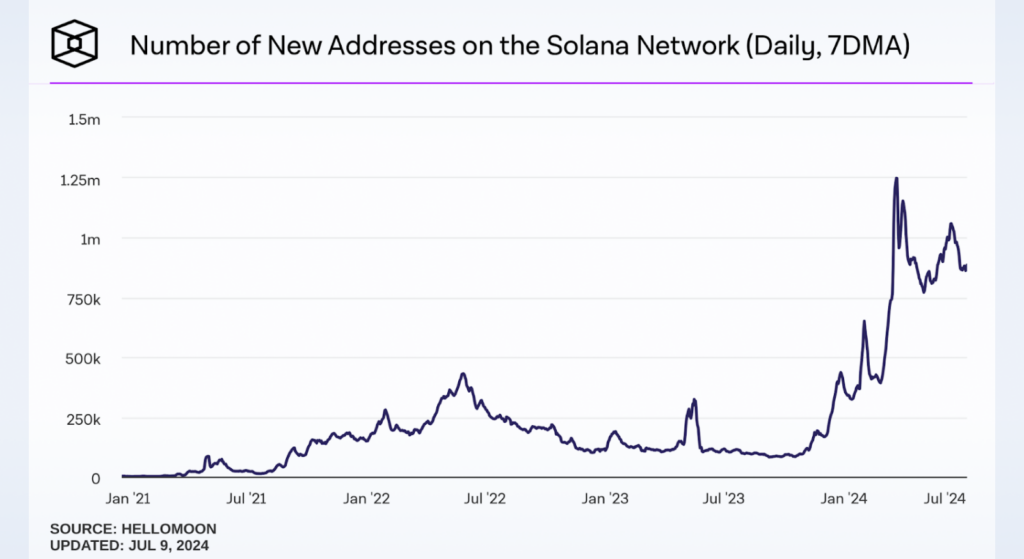

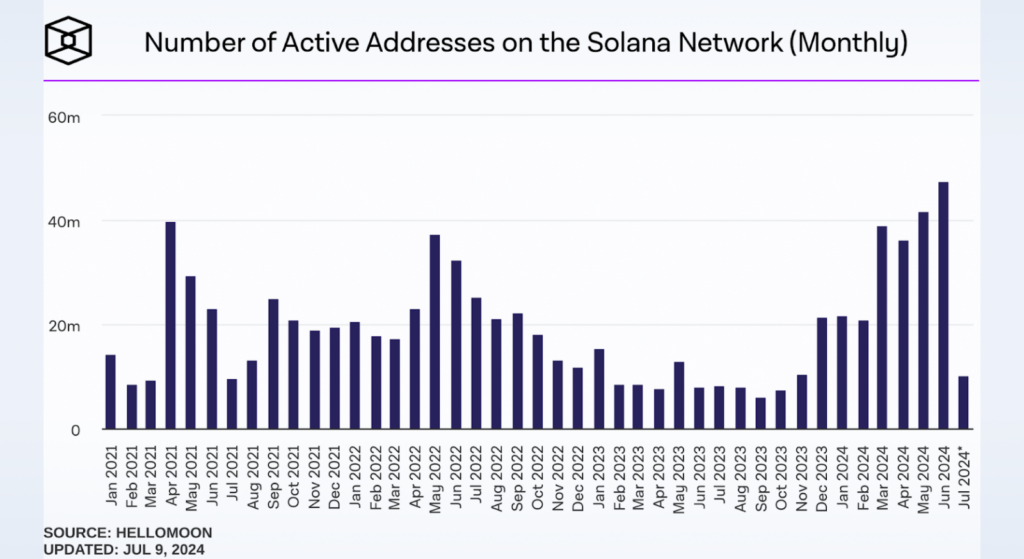

The number of new addresses in Solana every day reached 1.25 million in 2024.

In total, there are more than 47 million active unique addresses in the network.

- DeFi expansion. The decentralized finance ecosystem in Solana is rapidly expanding. The development of more innovative projects can attract a larger user base and more developers, thereby increasing Solana’s adoption. Bitbanker platform presents convenient and profitable tools for earning money on DeFi.

- NFT market. The burgeoning NFT market on Solana, with popular projects like STEPN and Mad Lads, has the potential to drive significant user engagement and increase transaction volume.

- Gaming and metaverse. Solana’s capabilities are well-suited for blockchain gaming and metaverse applications, such as Star Atlas.

- Cross-Chain interoperability. Cross-chain compatibility would enable seamless asset transfers and interactions between different blockchain ecosystems, broadening Solana’s appeal.

- Institutional adoption. Fostering partnerships with financial institutions and large corporations can stimulate large capital inflows and mass adoption.

- Technological innovations. Continued innovation in its core technology, like enhancing the Proof of History (PoH) and Proof of Stake (PoS) mechanisms, can ensure sustainability and competitiveness.

Future Outlook and Investment Considerations

Solana (SOL) is poised for significant growth, driven by technological advancements, an expanding ecosystem, and broader market trends.

When will Solana recover to its highs? According to analysts’ predictions, Solana may reach a peak of $200, with an average price around $150 and a potential low of $80. This growth is anticipated to be driven by upcoming market events and increasing institutional interest. The expanding number of token accounts and new projects within the Solana ecosystem underscore its growing adoption and utility.

However, it’s crucial for investors to assess the risks involved. Network outages could impact Solana’s reliability and investor confidence, while regulatory changes might affect its operations. As with all cryptocurrencies, Solana’s price is highly volatile. Investors should be prepared for significant price fluctuations and consider their risk tolerance carefully.