Practically every crypto investor has resorted to using stablecoins — cryptocurrencies pegged to some asset, usually the US dollar.

Stablecoins serve as the primary currency for conducting payments, as their value remains stable, and transactions are processed quickly.

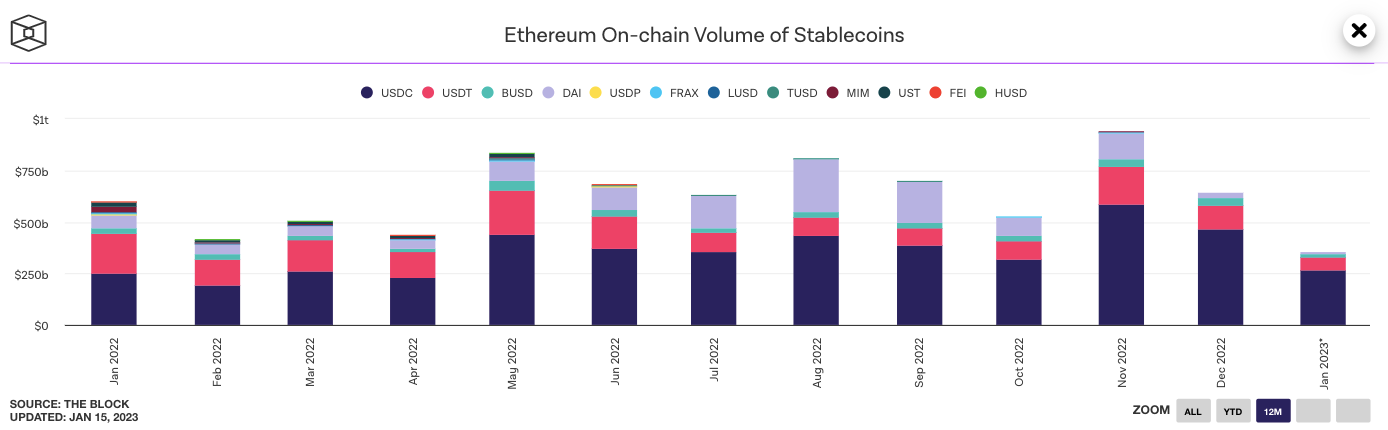

The stablecoin market is vast, offering dozens of types of coins that differ in management systems, collateralization methods, popularity, and so on. However, the majority of the market is dominated by the four largest stablecoins.

Let’s figure out the principles by which to determine which stablecoin is more reliable, convenient, and secure.

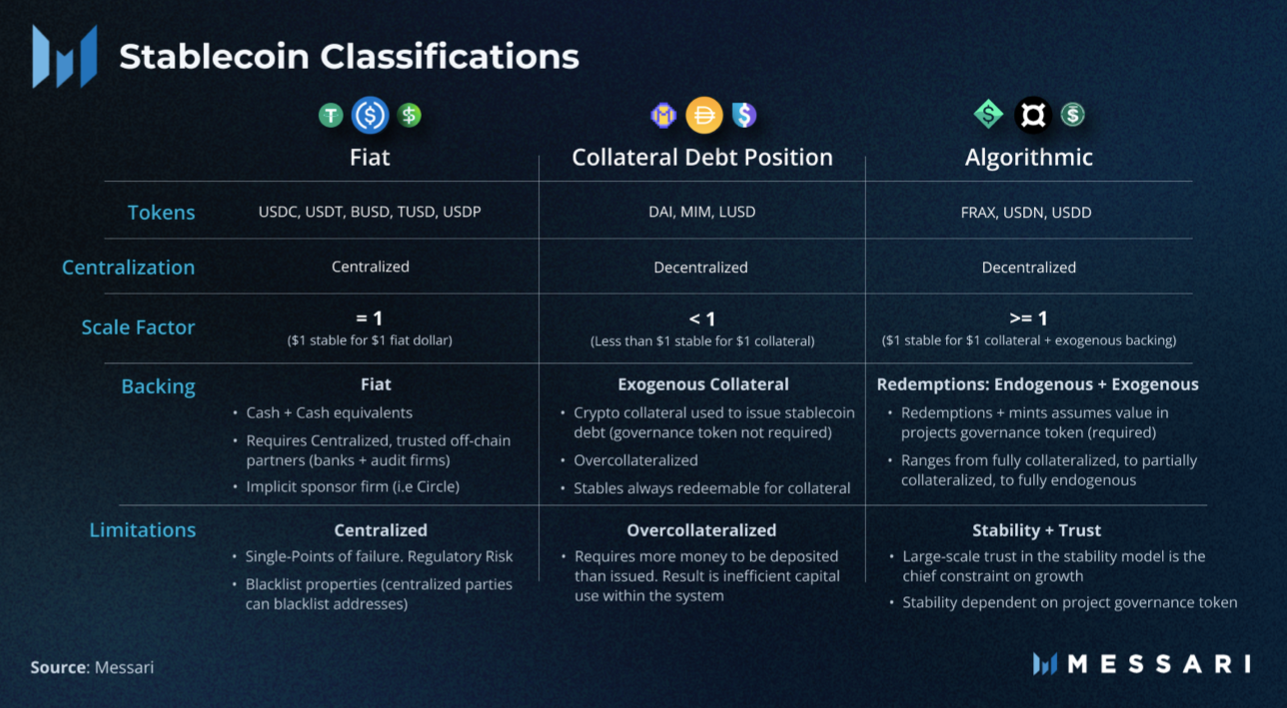

Classification of Stablecoins

Stablecoins are mainly divided into two groups:

1. Decentralized stablecoins.

2. Centralized stablecoins.

Centralized organizations, such as USDT, have complete control over the issuance of the stablecoin and its overall infrastructure. In contrast, decentralized projects lack a single owner, making it impossible to significantly change the principles of such a stablecoin’s operation.

Typically, centralized organizations offer stablecoins pegged to fiat currencies like the US dollar (USD), euro (EUR), or others. Decentralized projects cannot establish a direct link to any real-world asset, so only centralized organizations can back a stablecoin with real currency.

USDT

USDT, the first stablecoin, was introduced in 2014 and was initially named Realcoin but was later rebranded.

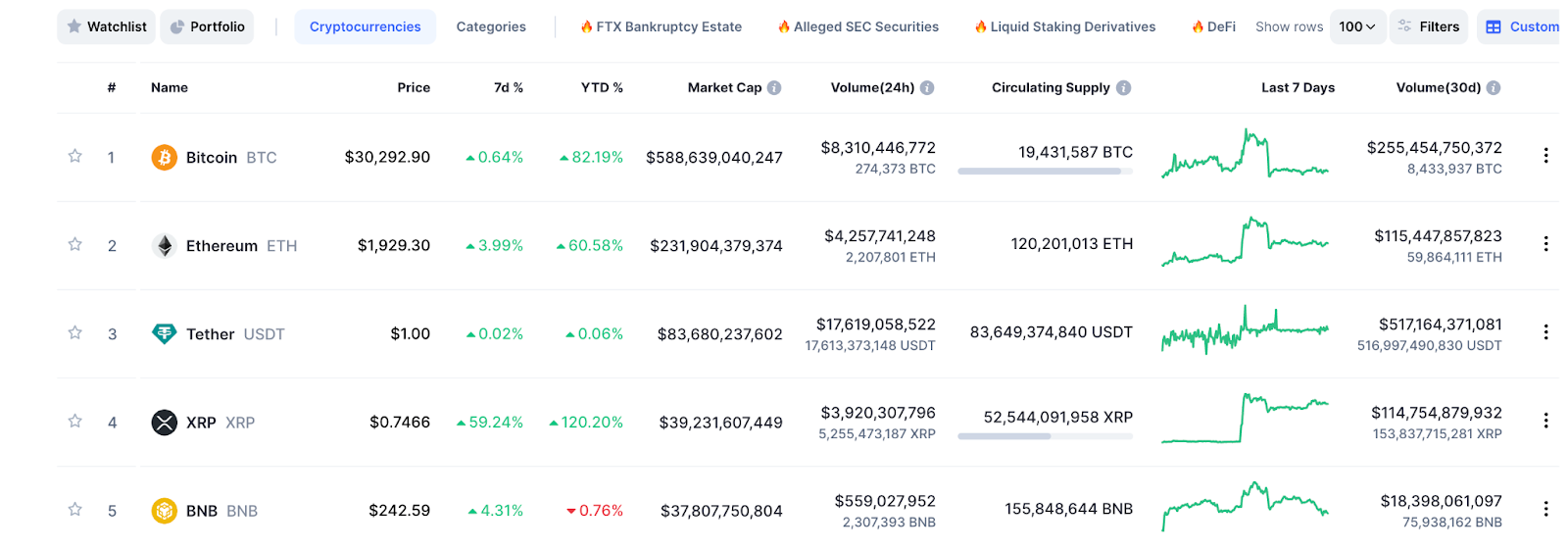

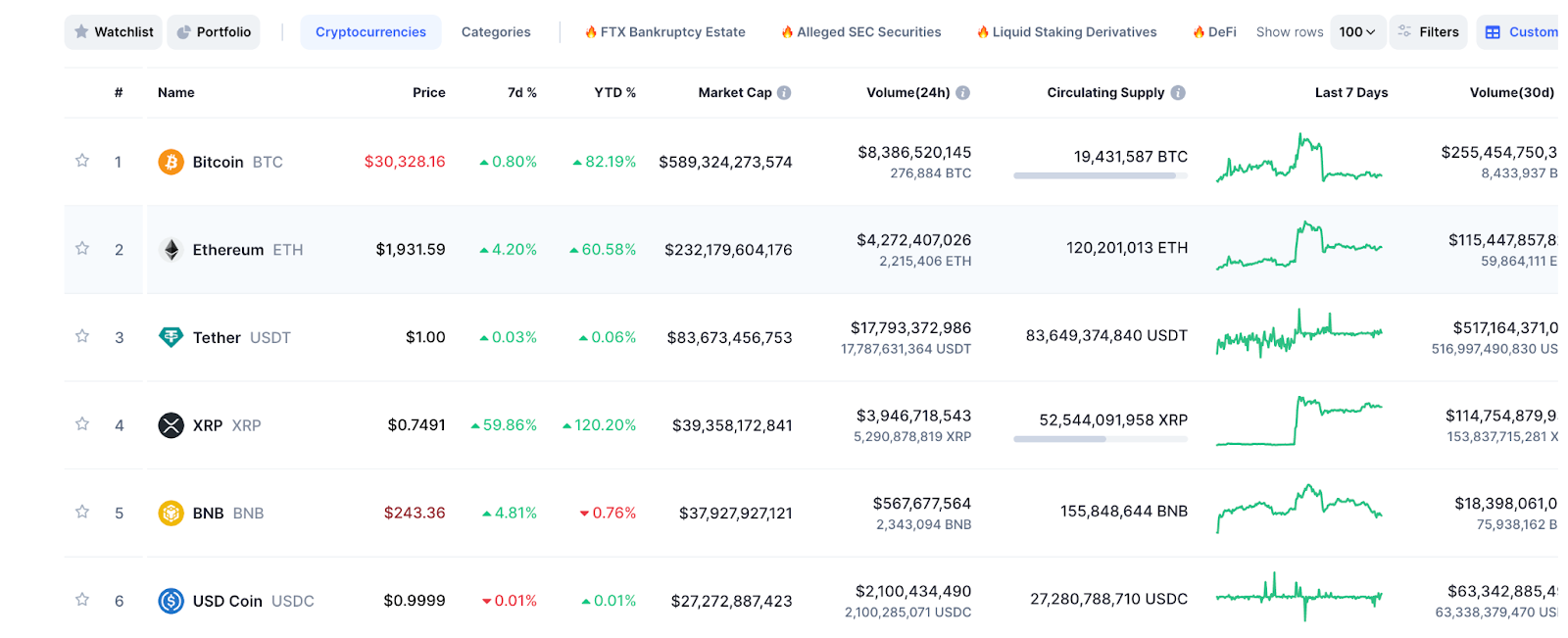

USDT holds the third position in the cryptocurrency ranking according to CoinMarketCap and currently surpasses even Bitcoin and Ethereum in terms of trading volume.

USDT was originally created on the Bitcoin blockchain using the Omni Layer protocol. However, it has now been issued on other blockchains as well, including:

1. TRON (TRC-20)

2. BNB Smart Chain (BEP-2)

3. EOS

4. AVAX C-Chain

5. BNB Beacon Chain (BEP-20)

6. Algorand

7. Solana

8. Polygon

9. Tezos

10. OMG Network

11. Ethereum (ERC-20) and others.

A significant portion of USDT’s supply is concentrated on the TRON blockchain. However, the stablecoin is also used on other networks. The second most popular and widely used network for USDT is Ethereum.

We have already discussed the differences between the ERC-20, TRC-20, and BEP-20 networks for USDT operations in one of our articles; you can find the material through the link.

How USDT Issuance Works

The issuance of USDT tokens is managed by the company Tether Limited.

When a user sends fiat money to the company’s bank account, Tether Limited creates a token in a 1:1 proportion to the fiat dollar. In other words, for every dollar sent, 1 USDT is issued and sent to the user, putting the tokens into circulation.

The withdrawal from circulation occurs in the same manner, but in reverse: USDT is sent back to Tether Limited, and fiat money is transferred to the user. Afterward, the token is destroyed.

Tether Limited is involved in the issuance of not only USDT tokens but also other stablecoins linked to different fiat currencies:

EURT — a Tether coin pegged to the euro;

CNHT — a Tether coin pegged to the Chinese yuan;

XAUT — a Tether coin pegged to real gold.

As of April 17, 2023, 84 billion USDT has been issued, while on December 30, 2022, 73 billion USDT were in circulation. The token’s issuance is not limited, as it depends on the amount of assets backing the stablecoin. Roughly speaking, USDT can be issued indefinitely as long as there are sufficient assets to back it.

Currently, there are 66 billion USDT in circulation.

USDT Collateralization

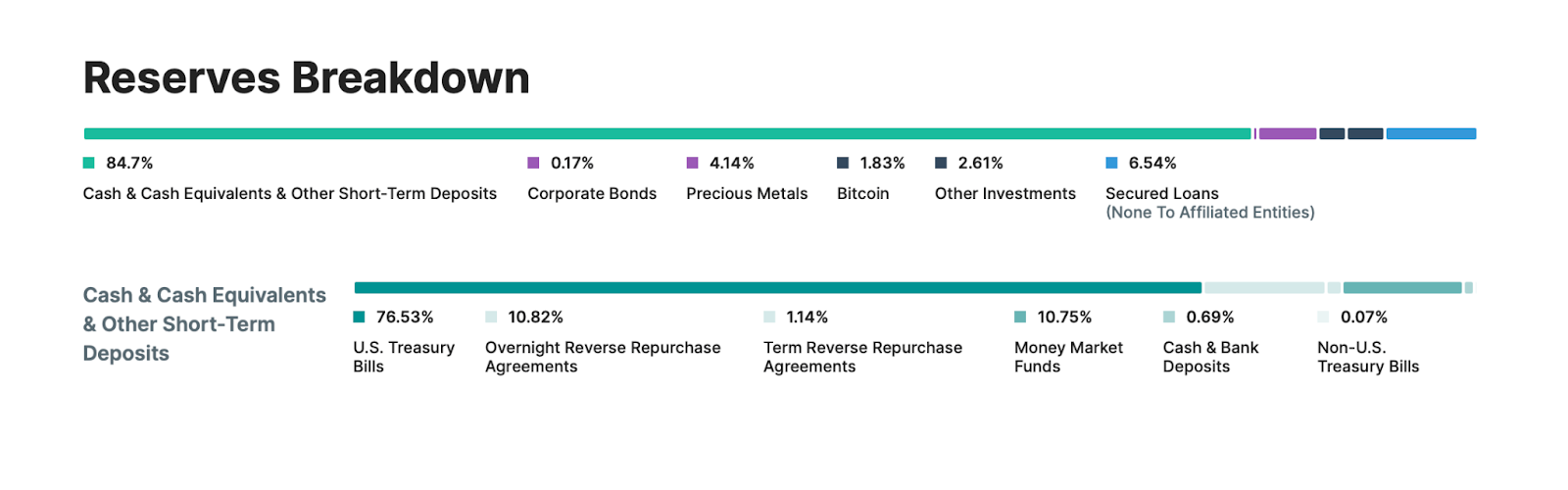

Tether backs USDT with US dollars (USD), US Treasury bills, and other securities.

Officially, Tether holds the following reserves:

- Cash & Cash Equivalents & Other Short-Term Deposits — 84.7%;

- Corporate Bonds — 0.17%;

- Precious Metals — 4.14%;

- Bitcoin — 1.83%;

- Other Investments — 2.61%;

- Secured Loans (None To Affiliated Entities) — 6.54%.

Unfortunately, there is currently no project that fully backs its stablecoin with real US dollars. However, Tether has been in existence for 8 years and has survived multiple economic crises. Despite scandals, it continues to maintain a 1:1 peg.

What to Be Cautious About if You Have USDT

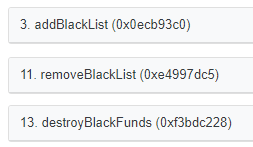

Tether has the capability to freeze and unfreeze USDT accounts across all ecosystems in which it operates. There is also the possibility of zeroing out the balance of a frozen account, which you can verify independently.

Only Tether has access to these capabilities. They are usually employed to restrict the actions of hackers attempting to breach various projects. Blockchain does not record data about your location, but keep in mind that wallets, even decentralized ones, might collect data.

Tether began implementing these account freezes back in 2017. The first address was blocked due to an alleged theft of $30 million.

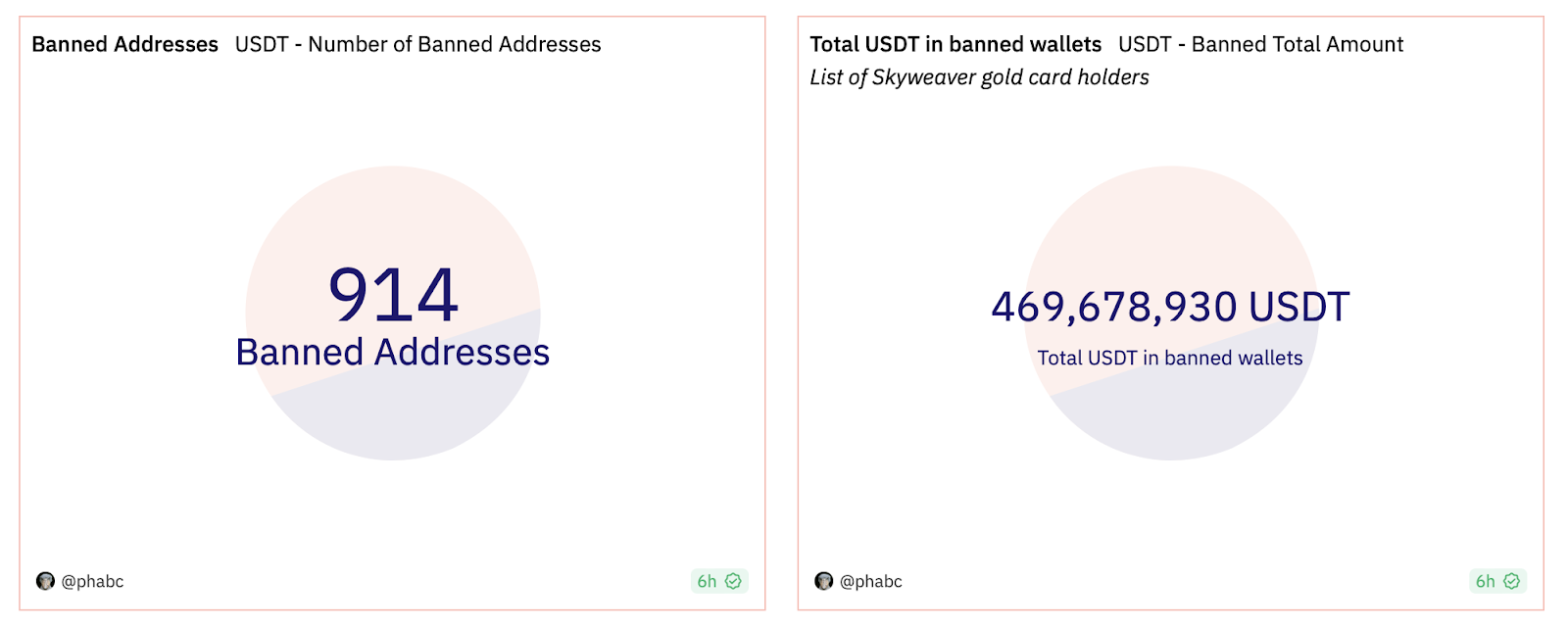

Currently, 914 wallets with 469 million USDT are blocked. In early 2022, there were only 560 blocked wallets.

Additionally, Tether utilizes these functions upon the request of law enforcement agencies. For instance, 46 million USDT belonging to the FTX exchange were temporarily blocked based on such a request.

There is also an advantage of this function for regular users. If you mistakenly send your USDT to the wrong address, you can submit a request for their recovery. Requests are accepted for amounts starting from $1000.

Tether charges a fee of up to 10% of the recovery amount or $1000 USD (whichever is higher) for the retrieval of Tether tokens. The fee will be deducted from the reimbursement amount.

The procedure involves many complexities and limitations, so it is better not to lose your USDT, as recovering them can be very challenging.

USDC

USDC was introduced in 2018, created by Circle in collaboration with Coinbase exchange.

USDC ranks 6th in the cryptocurrency ranking according to CoinMarketCap. Its daily trading volume is about 8.5 times lower than USDT’s, but despite this, the stablecoin remains popular.

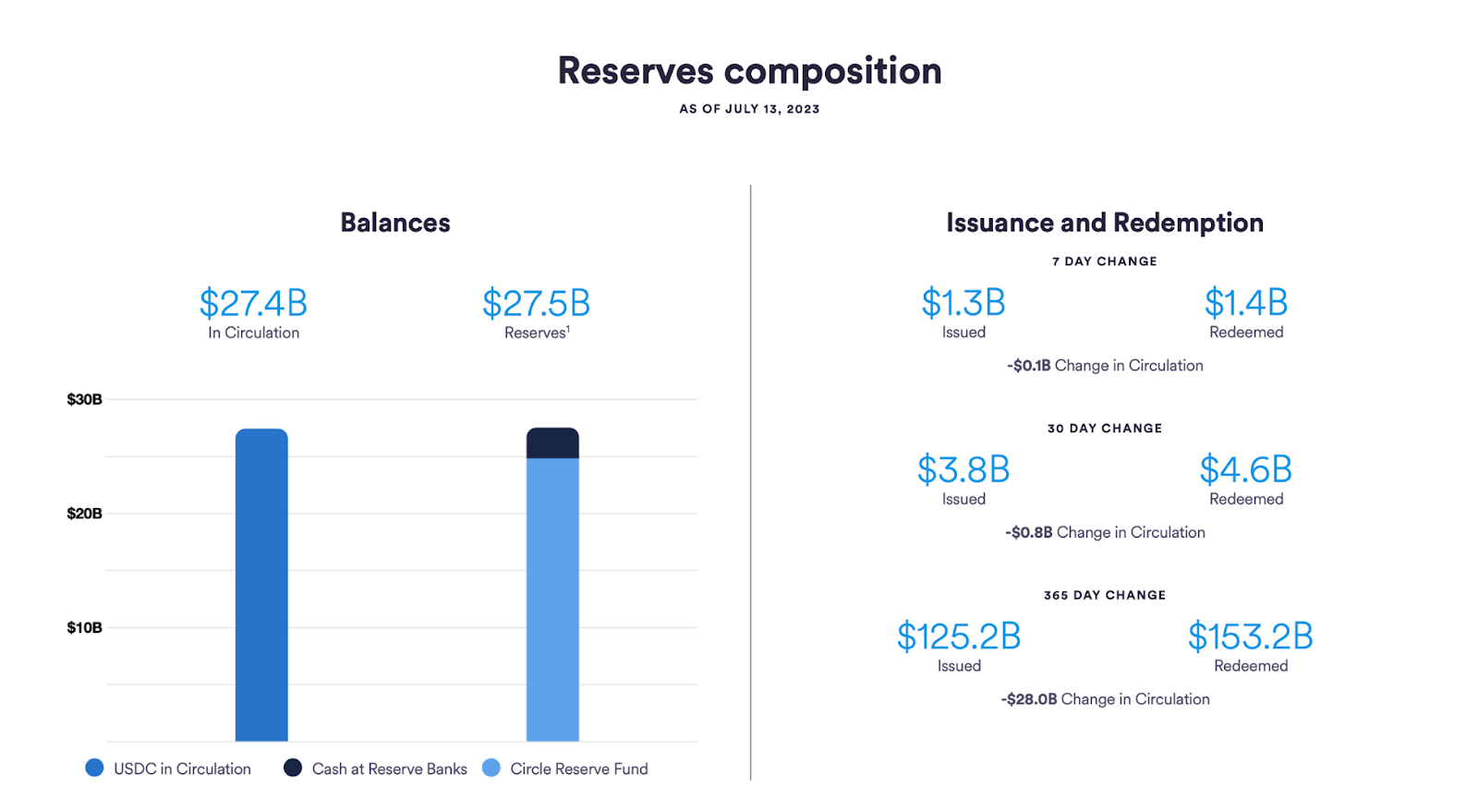

The Circle website displays statistics for USDC, which is updated daily.

USDC was initially launched on the Ethereum blockchain as an ERC-20 token, but currently, it operates on other networks as well, including:

1. Algorand

2. Avalanche

3. Flow

4. Hedera

5. Solana

6. Stellar

7. TRON

8. Polygon (via a cross-chain bridge).

USDC Collateralization

Circle holds reserves for USDC in cash and short-term US Treasury bonds. The current proportion is 9% ($2.7 billion) in cash and 90% ($24.8 billion) in short-term US Treasury bonds.

These reserves are managed by major organizations, including BlackRock, Bank of New York, and BNY Mellon, which minimizes concerns in the market about the sufficiency of their reserves.

Currently, reports on reserves are published once a month.

How USDС Issuance Works

The mechanism for issuing USDC is identical to the mechanism used for USDT, so we won’t delve deeper into this topic.

What to Be Cautious About if You Have USDС

Circle has the ability to freeze wallets. In 2022, an example of this was the blocking of wallets containing over 75,000 USDC belonging to the Bitcoin mixer, Tornado Cash. Also, in 2020, $100,000 worth of USDC was blocked upon the request of law enforcement agencies.

In essence, USDC aims to become the United States’ official stablecoin. Circle operates as a regulated company in the USA, unlike Tether, even though Tether also freezes funds based on government requests.

On March 11, 2023, USDC lost its peg to the US dollar and traded at $0.92 after its issuer, Circle, announced holding $3.3 billion in reserves with the government-regulated Silicon Valley Bank (SVB). The exchange rate has now recovered.

BUSD

BUSD was created by Paxos and Binance in 2019. Among the popular major stablecoins, it is the youngest.

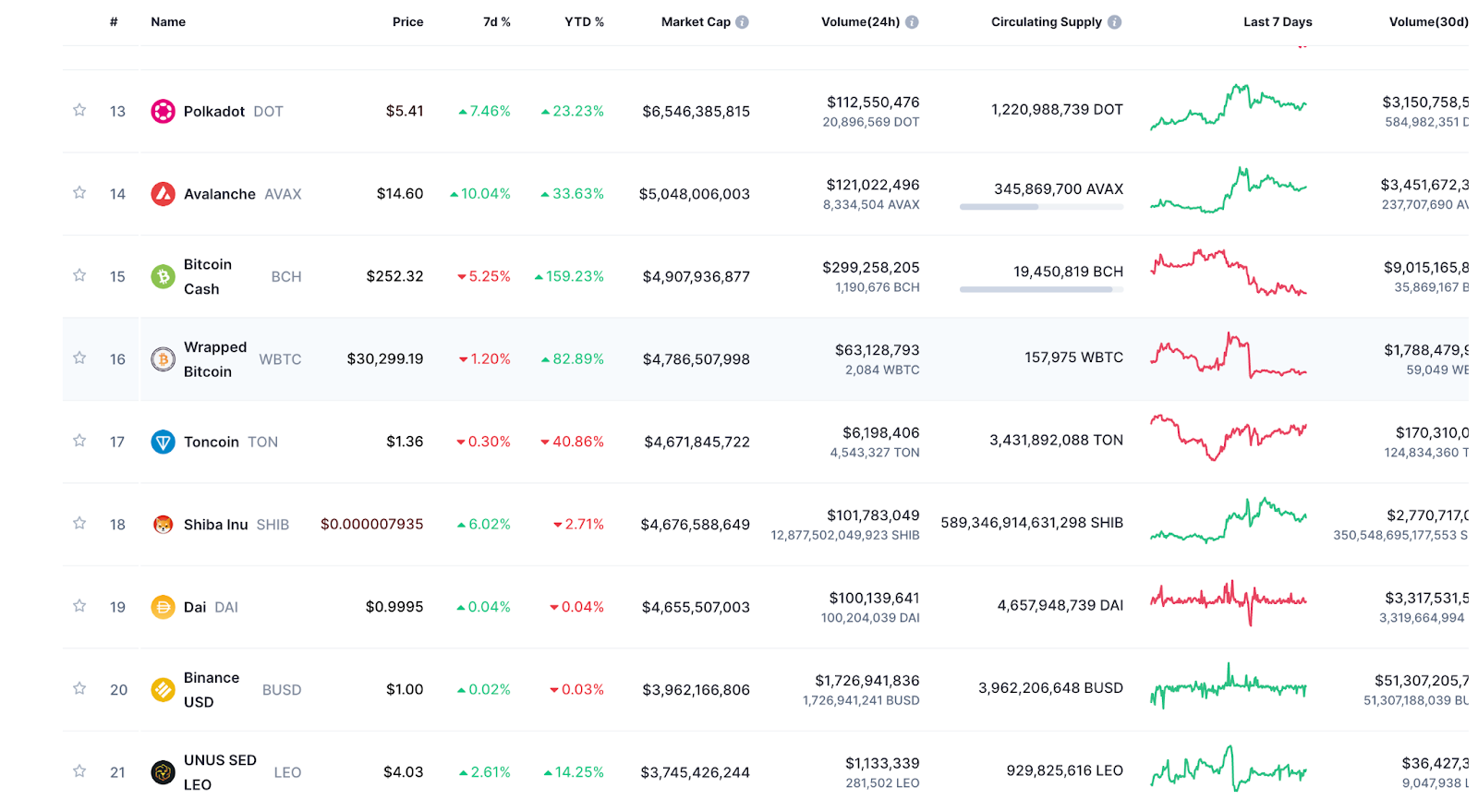

BUSD ranks 20th in the cryptocurrency ranking according to CoinMarketCap. Its daily trading volume is about 10 times lower than USDT’s.

BUSD is issued on the Ethereum blockchain as an ERC-20 token. Additionally, Binance issues tokens on the BEP-20 network and stores them in an Ethereum address (ERC-20).

BUSD can be moved between networks through withdrawals on the Binance exchange or via the Binance Bridge.

How BUSD Issuance Works

BUSD (ERC-20) is issued by Paxos using the same mechanism as USDC and USDT. However, due to an investigation with the company, Paxos has temporarily halted the issuance of BUSD (ERC-20). Until February 2024, the issuer will continue to support issuance and conversion operations.

BUSD (BEP-20) is a token linked to BUSD (ERC-20) and is issued solely by Binance. It is not associated with Paxos and is therefore not subject to regulation by the New York State Department of Financial Services, unlike BUSD (ERC-20).

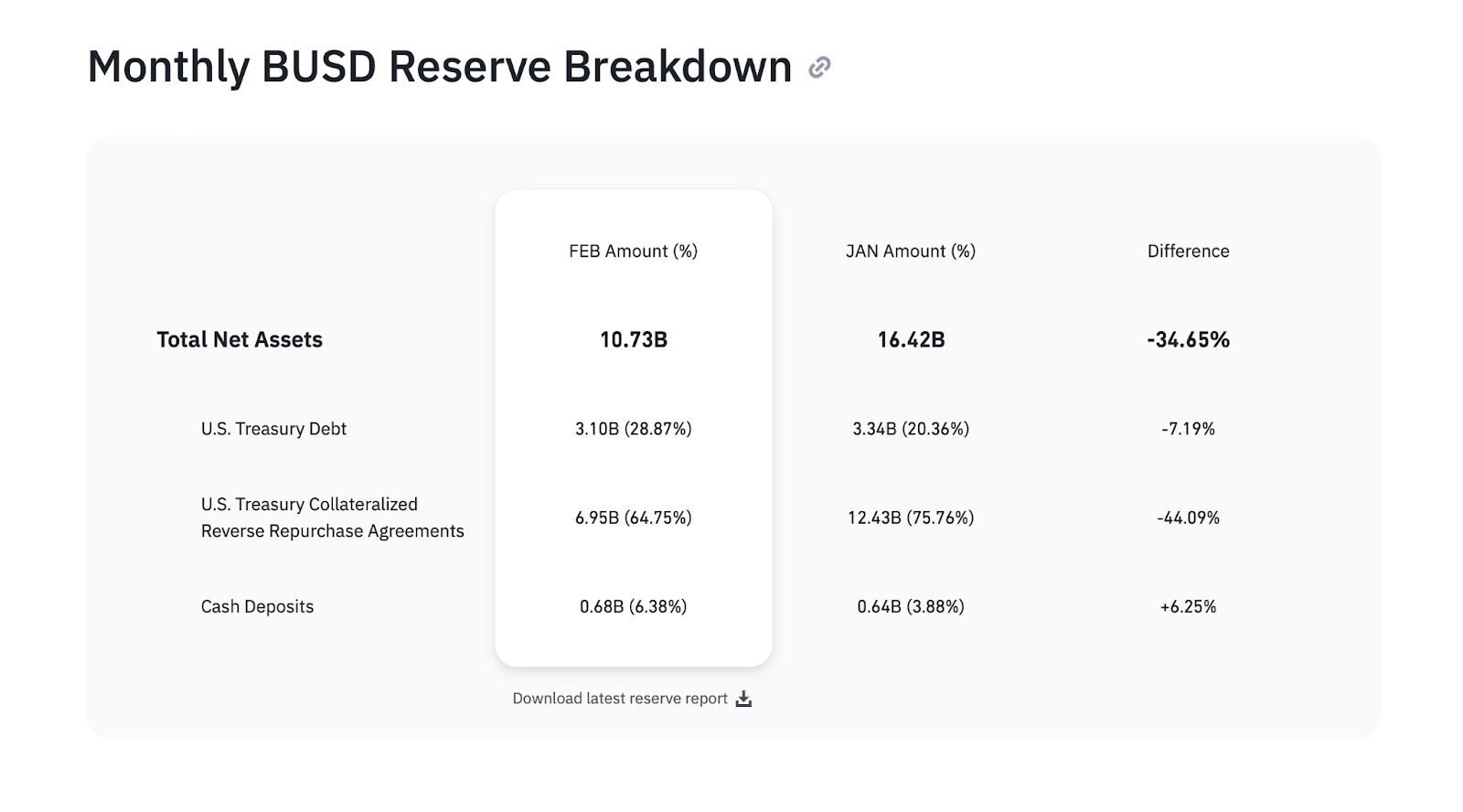

BUSD Collateralization

The reserves for BUSD (ERC-20) consist of American debt obligations and fiat.

Since BUSD (BEP-20) is issued by Binance and is not linked to Paxos, the stablecoin is not backed by dollars but rather by BUSD (ERC-20) tokens, which are held in reserves by the exchange.

What to Be Cautious About if You Have BUSD

BUSD has never been frozen in the wallets of its holders, but such a possibility always remains since the stablecoin is centralized.

Despite the news related to Paxos, the stablecoin has not lost its peg to the dollar. However, the situation after Paxos ceases operations with BUSD remains uncertain.

Decentralized Stablecoins

Such coins maintain their value through smart contracts, which automatically work to support the coin’s value. Here, stablecoins can be further divided into two types: algorithmic and over-collateralized with BTC, ETH, or other popular cryptocurrencies.

Over-collateralized Stablecoins

Usually, the value of such coins is supported by other fundamental and highly liquid crypto-assets, such as ETH, BTC, or BNB.

Coins like DAI, USDD, MIM represent this niche. In essence, they are algorithmic (since management occurs automatically), but they are not commonly referred to as such. Let’s take a closer look at how DAI operates.

DAI

DAI was launched by the MakerDao project and currently ranks 19th in the cryptocurrency ranking according to CoinMarketCap.

In the DAI contract, there is no provision to freeze accounts, so hackers usually prefer to convert all centralized assets into DAI immediately. This also means that your DAI coins cannot be taken away from you under any circumstances.

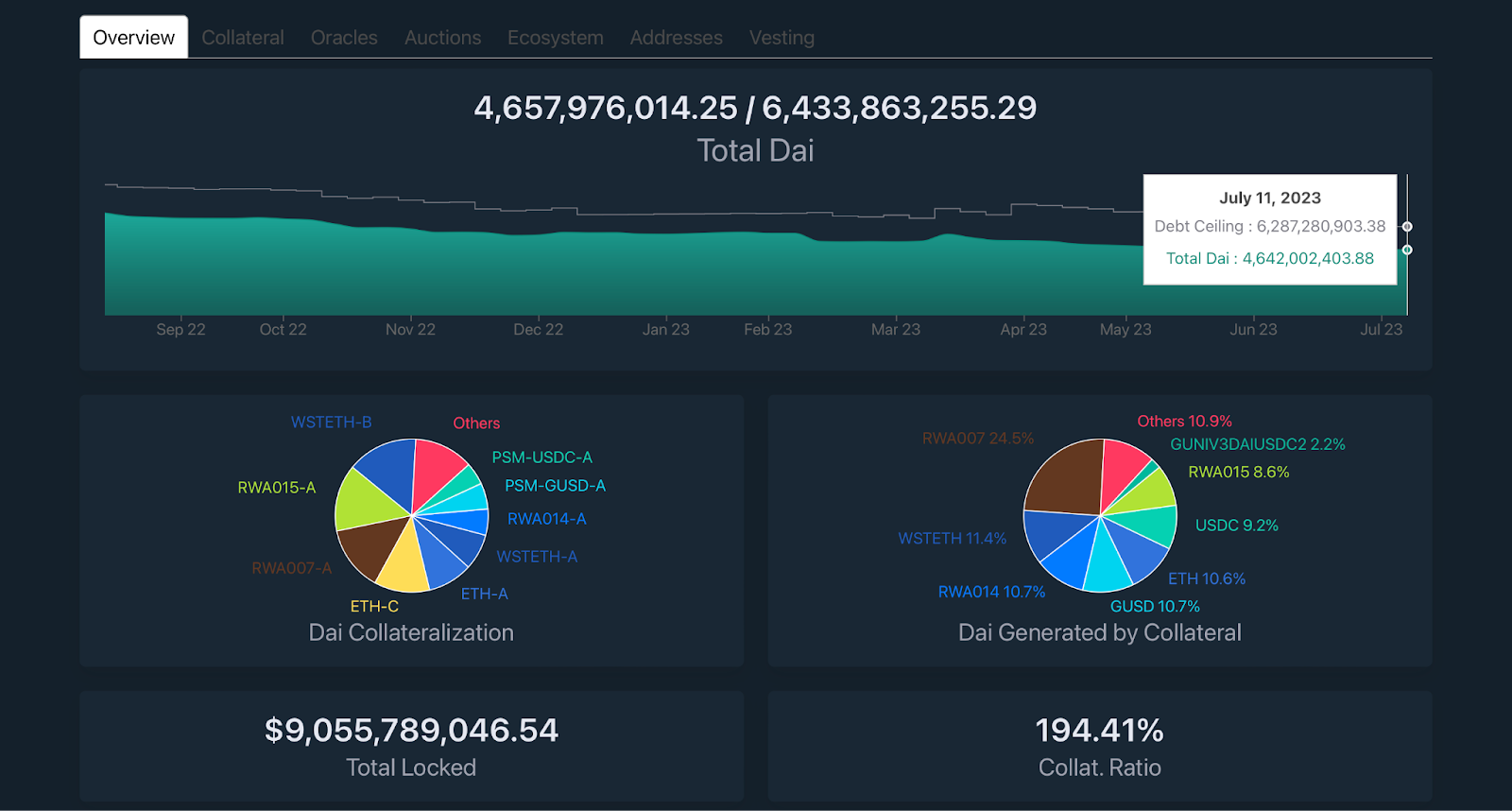

Collateralization and Issuance of DAI

The over-collateralization for DAI can vary between 150-200%. This means that if you want to obtain 100 DAI, you will need to provide another liquid asset equivalent to $150 to $200. When the price of your asset falls to the minimum required collateral, any blockchain user can liquidate your position by initiating the function within the DAI contract. Usually, this is done by bots that operate independently from DAI. This mechanism applies to the issuance of tokens; if you are buying DAI on an exchange, you don’t need to worry about this.

Currently, 4.65 billion DAI has been issued, with $9 billion worth of locked assets being used as collateral.

Risks of DAI

Half of the DAI reserves are held in USDC. If Circle were to freeze the USDC that are used as collateral for DAI, there is a risk that users may not be able to exchange their DAI back to USDC. However, this only applies to users who obtained DAI by providing collateral and issuing new tokens themselves, rather than purchasing them on an exchange or wallet.

Algorithmic Stablecoins

Algorithmic stablecoins are generally similar to the DAI-like coins mentioned above, but they use only one cryptocurrency as collateral, representing the blockchain they are based on. For example, if there were an algorithmic stablecoin on the Ethereum network, it would be backed solely by ETH.

For instance, the UST stablecoin is algorithmically backed by the LUNA token through specific manipulations.

When UST’s value increases, Terra mints and sells new UST tokens, using the proceeds to buy the native token of the blockchain, LUNA. Later, Terra exchanges LUNA for other assets, creating a fund to back LUNA, which would be used in crisis situations. When UST slightly declines in value, Terra mints LUNA tokens and exchanges them for UST.

To increase the capitalization of algorithmic stablecoins, projects offer incentives to deposit funds in these coins, providing attractive annual yields. Terra offered up to 20% annual yield, attracting capital from other stablecoins to UST.

The problem with such projects is that they often resort to aggressive strategies to attract funds, sacrificing security guarantees. Moreover, the backing for such coins is usually 1:1, and with the promised high annual interest rates, there was a risk of insufficient backing even in a stable market.

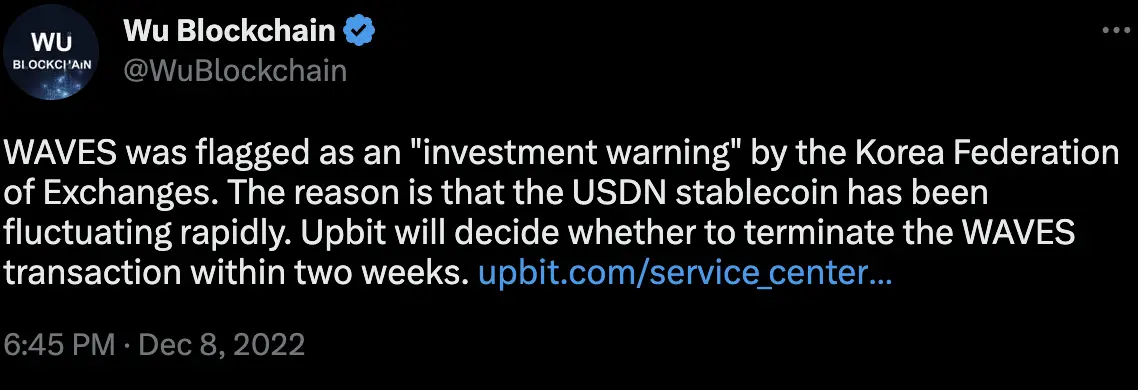

Currently, algorithmic stablecoins lack trust due to the history of UST’s crash and the loss of USDN peg, so few people are willing to store their savings using such coins. In the USA, there are plans to ban algorithmic stablecoins for two years.

Risks Associated with Stablecoins

Moving on to the risks associated with owning stablecoins, it is essential to note that they are not without risks, although they are designed to be less volatile than other cryptocurrencies. Here are some of the risks to keep in mind:

Counterparty Risk

Stablecoins are often issued by a central entity, such as a company or financial institution. This means that investors are exposed to counterparty risk, which is the risk that the issuer will default or go bankrupt, resulting in investors losing their funds. If you hold USDT, you are exposed to the risk that Tether Limited, the company that issues them, may default or go bankrupt.

In March 2023, the price of USDC fluctuated significantly and dropped sharply due to concerns about the company’s reserves and banking issues. Investors who did not ensure the safety of their USDC holdings risked and lost significant amounts of money due to the sudden price drop.

Regulatory Risk

Stablecoins are subject to regulatory risk. Regulatory authorities may take actions against the issuer or the stablecoin itself. If it is found that a stablecoin violates securities laws, regulatory measures can be taken, leading to a decrease in the stablecoin’s value.

For example, in February 2023, the New York State Department of Financial Services prohibited the issuer of BUSD from issuing the stablecoin.

Market Risk

Despite stablecoins being designed to maintain a stable value, they are still subject to market risk. The value can decrease due to changes in market conditions; if the demand for a specific stablecoin decreases, its price may fall. This risk is closely related to others, as news and issues related to the stablecoin can trigger a selling incentive.

Liquidity Risk

Stablecoins are only as liquid as the market on which they are traded. If there are few buyers and sellers for a particular stablecoin, it may be difficult to buy or sell it.

Technological Risk

Stablecoins often rely on blockchain technology, which is still in its early stages of development. This risk is mainly associated with algorithmic stablecoins, as their price is regulated by an algorithm. If the algorithm fails or is not well-designed, it can result in investment losses, as happened with UST (TerraUSD).

Confrontation Among Stablecoins

Stablecoins are competing against each other for supremacy. USDT consistently maintains a leading position, but other tokens actively contend for it. Let’s explore the methods used in the battle among stablecoins.

Information Warfare

This is the most fundamental way of rivalry in the stablecoin market. Companies need to sway users to choose their product, but it’s challenging to do so by only highlighting their advantages.

By their nature, stablecoins are similar. They differ in terms of decentralization, methods of maintaining their value, mechanisms of collateralization, and the assets to which their price is pegged.

Since it’s challenging for similar stablecoins to compete based on user benefits, as they are not significantly different, especially from the perspective of non-expert users, companies initiate information warfare.

Before selecting a stablecoin, users want to understand which one is more reliable, which one is more advantageous to use, and what sets them apart. Consequently, users start searching for information on the internet. Therefore, the primary task for the issuer is to maintain a high reputation and, if possible, criticize competitors.

Often, information warfare is not waged directly by companies, as it would seem improper and too obvious to point out their desire to undermine competitors.

How Information Wars are Conducted

After the crash of LUNA, the topic of reserves held by stablecoin issuers came to the forefront again. Tether, which had previously faced scandals related to possible insufficient reserves, came under scrutiny. As a result, companies had to disclose details about their reserves and undergo audits.

Let’s not forget about LUNA itself, whose crash was accelerated by an FUD campaign from Alameda Research, where SBF carried out some manipulations with the purchased UST token to enter into a massive short position. To ensure success, media outlets were financed to publish articles with a skeptical undertone towards Terra. The same tactics were later employed against the USDN token from Waves. It is no secret that algorithmic stablecoins were closely associated with financial pyramids and had insufficient collateral, which is why the FUD campaigns against them proved successful.

In December 2022, the Korean Federation of Exchanges warned of the dangers of investing in USDN due to its price fluctuations. This led to a decrease in the stablecoin’s market capitalization and a detachment of its price from the dollar.

On December 1, 2022, WSJ published an article criticizing Tether. The article stated that “the company behind the stablecoin Tether increasingly provides its own coins to customers instead of redeeming them for solid currency in advance. This shift increases the risk that the company may not have enough liquid assets to meet its obligations in times of crisis.”

According to WSJ, as of September 30, Tether’s outstanding loans reached $6.1 billion, which accounts for 9% of the company’s total assets.

In response to the accusations, Tether stated that WSJ mistakenly treated USDT itself as collateral, which is the foundation of the stablecoin.

Reuters has also repeatedly published articles with criticism and allegations against the Binance exchange:

- Exclusive: U.S. Justice Dept is split over charging Binance as crypto world falters | Reuters

- How Binance became a hub for hackers, fraudsters and drug sellers

- Special Report: How crypto giant Binance built ties to a Russian FSB-linked agency | Reuters

The exchange was accused of weak anti-money laundering controls, transferring user data from Russia to the FSB, processing payments from criminals totaling over $10 billion, planning to circumvent regulatory authorities in the US and other countries. Binance consistently denies the agency’s accusations.

Despite the attacks being directed at the exchange and not its stablecoin, it still has an impact on BUSD. After the December report by Reuters, BUSD’s market capitalization decreased by 16%.

Open Confrontation

Issuers do not always fight on the informational battlefield. Often, the confrontation is open, and the methods of such battles can vary.

Competitive Advantage

While most stablecoins could offer a passive income of no more than 7% annually, Terra introduced Anchor Protocol, where one could earn up to 20% through UST staking. This led to a capital outflow from other stablecoins since Anchor supported only one token. Additionally, people actively took loans from banks and converted fiat to crypto as Terra offered interest rates several times higher. As a result, UST quickly rose to the top 10 in CoinMarketCap’s market capitalization. No stablecoin had gained popularity so rapidly.

Teamwork

On September 29, 2022, Binance stopped supporting USDC, USDP, and TUSD stablecoins, and balances in these currencies were converted to BUSD. As a result, in two months, the market capitalization of USDC decreased by $10 billion. The exchange also promoted trading pairs with BUSD as an alternative to USDT, with lower transaction fees for BUSD.

In early December 2020, Coinbase started urging its users to transfer assets from USDT to USDC. The official reason given was market instability. The exchange encouraged users to choose the proven and reliable USDC to safeguard themselves. To simplify the transfer, Coinbase waived the conversion fee from USDT to USDC.

Coinbase has a direct relationship with USDC, as the exchange was one of the participants in the stablecoin’s launch. This is an example of overtly attracting the audience of competitors.

Allies

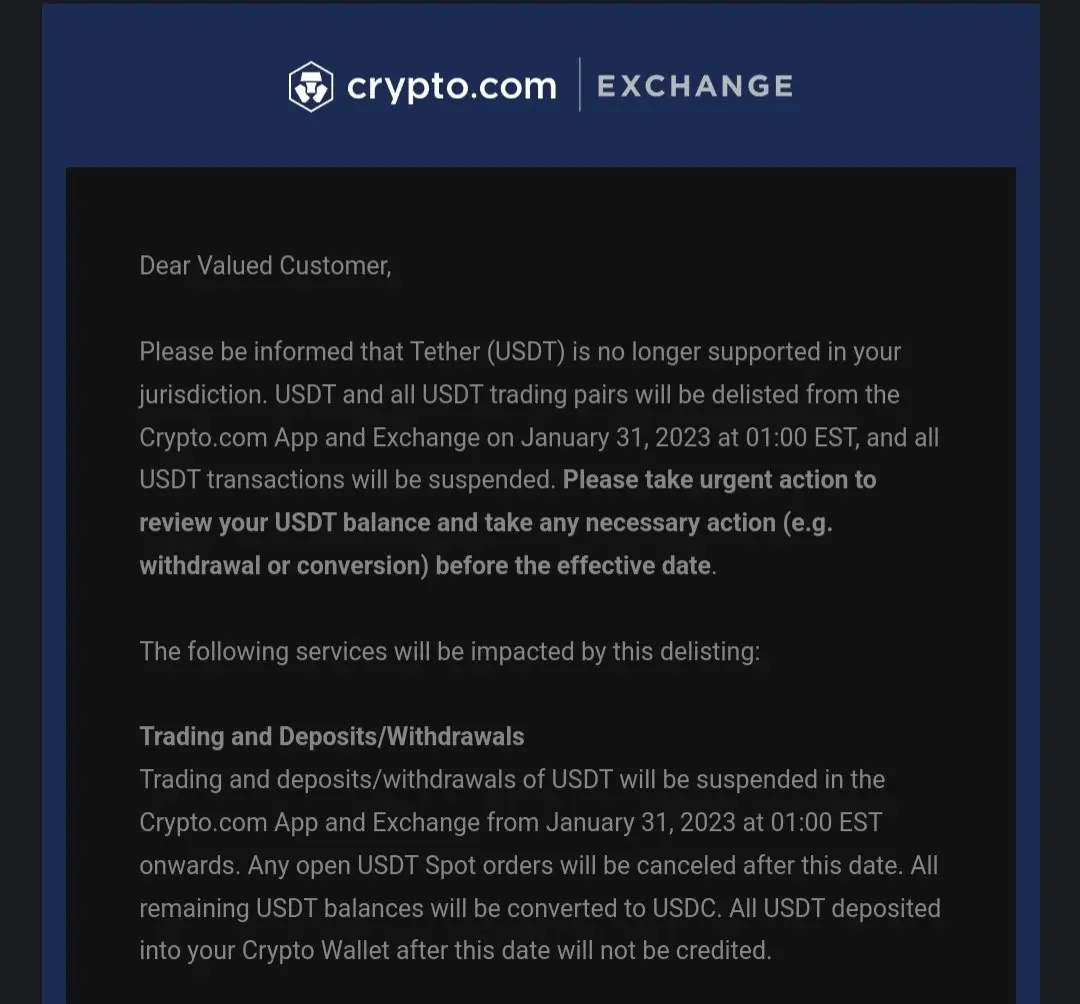

The Ontario Securities Commission prohibited the use of USDT. As a result, on January 31, 2023, USDT was delisted from the Crypto.com exchange for Canadian users. USDT will be automatically converted to USDC.

Companies issuing stablecoins are making significant profits even by the standards of the cryptocurrency industry. Tether reported a profit of $700 million for the fourth quarter of 2022, which represents 1% of the total USDT market capitalization.

These organizations earn money through short-term investments of the funds that back their stablecoins. They also provide services for redeeming the tokens in exchange for fiat currency, typically charging a commission of 0.1% of the amount.

Therefore, the stablecoin wars will continue, gaining momentum. As long as there is not just one stablecoin in the world, the competition will persist, and achieving that scenario seems unlikely.

Which stablecoins to use?

Stablecoins are commonly used to preserve capital before a crisis or simply when one doesn’t want to hold a volatile balance.

Additionally, stablecoins are often used for cryptocurrency transactions due to their quick processing, low fees, and absence of exchange rate volatility.

USDT is the most popular USD-pegged cryptocurrency, having withstood the test of time.

BUSD and USDC are less popular stablecoins also pegged to the USD.

Other stablecoins, including DAI, lag behind them significantly.

It’s difficult to say which stablecoin is the best as each has its advantages. The best approach is diversifying your portfolio if you’re concerned about holding all your assets in one cryptocurrency.